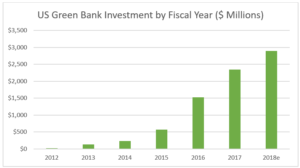

Green Banks in the US have been powerful tools for driving capital into clean energy markets. CGC reviewed annual reports and transactions at nine US-based Green Banks from their inception through fiscal year 2017. At the end of 2017, these institutions participated in transactions representing more than $2.3 billion of cumulative clean energy investment. Nearly $1.7 billion of the overall investment came from private sources, demonstrating the continuing ability of Green Banks to leverage private dollars into clean energy markets.

CGC reviewed annual reports and transactions at nine US-based Green Banks from their inception through fiscal year 2017. At the end of 2017, these institutions participated in transactions representing more than $2.3 billion of cumulative clean energy investment. Nearly $1.7 billion of the overall investment came from private sources, demonstrating the continuing ability of Green Banks to leverage private dollars into clean energy markets.

Over the past six years, public to private leverage ratios have increased as Green Banks become more effective at crowding in private investment. In the past year, leverage ratios hit all-time highs. For example, the Connecticut Green Bank achieved a public to private investment leverage ratio of 8:1 for FY 2017, double the 4:1 ratio achieved in FY 2014. This new high raises Connecticut Green Bank’s overall leverage ratio to 6:1. Future leverage ratios are expected to increase as Green Banks develop streamlined methods for attracting private capital. For example, the New York Green Bank, which currently has an overall leverage ratio of 3:1, expects to increase its overall leverage portfolio to 8:1 by 2025.

Notable projects in FY 2017/2018 included New York Green Bank’s $54.3 million loan to Motivate International, parent of the Citibike bike share network. This marks one of the first major transactions in clean transportation sponsored by a Green Bank, paving the road for greater activity in the sector. To date, the majority of observed Green Bank projects were solar and energy efficiency projects.

Ambitious projections from the New York Green Bank, Rhode Island Infrastructure Bank, and Michigan Saves have set Green Bank transaction totals on track to exceed $2.9 Billion by the end of fiscal year 2018. New Green Banks, including those CGC helped develop in Nevada and Colorado, will soon begin financing clean energy projects in their states as well. Operating under an independent, nonprofit model, these organizations represent a new wave of Green Banks that can drive investment into clean energy projects across the U.S. This activity cements a trend of increasing investment as new and existing Green Banks ramp up operations across the US.

As Green Bank operations grow in scale, new pools of capital are becoming available for Green Bank use. These include the $1 billion fund announced by the New York Green Bank for domestic investment, funds under development at NYCEEC and Inclusive Prosperity Capital (formerly part of the Connecticut Green Bank), and program related investment (PRI) from a variety of foundations expressing greater interest in the Green Bank movement.

To further catalyze Green Bank investment and capitalize on the observed trends, CGC is developing a new initiative called the American Green Bank Consortium. The Consortium, designed as a domestic trade association for Green Banks, will serve as the currently missing connective tissue in the Green Bank ecosystem to drive investment volume and efficiently share innovative clean energy financing practices among members. Members will include new and existing Green Banks as well as developers and capital providers that frequently partner with Green Banks. The Consortium is scheduled to launch in Q1 2019 and will work to catalyze even greater Green Bank investment over the coming years.

The nine Green Banks reviewed were: the California Lending for Energy and Environmental Needs (CLEEN) Center, the Connecticut Green Bank, the Hawaii Green Energy Market Securitization (GEMS) Program, the Montgomery County Green Bank, Michigan Saves, the New York City Energy Efficiency Corporation (NYCEEC), the New York Green Bank, the Rhode Island Infrastructure Bank, and the Solar and Energy Loan Fund (SELF).