The Clean Energy Future Blog

By Coalition for Green Capital

Two new reports from global leaders in climate finance identify the important role that public capital should play in scaling up private investment. Though neither explicitly names Green Banks, both effectively articulate the need for Green Bank-like solutions.

One report, from the Climate Policy Initiative, on key lessons in climate finance emphasizes the interaction of public and private finance:

National and international public finance play key roles building projects’ bankability by covering viability and knowledge gaps, driving huge increases in investment from the private sector.

Another report, authored by the International Finance Corporation, says there are $23 trillion in climate investment opportunities, and that public investment will play a crucial role in facilitating more private investment in that space:

Using public finance to scale up support for project preparation and development can play a critical role in encouraging investment. Furthermore, to attract private capital, investments must have adequate risk-adjusted returns and be of suitable size. This is particularly important in newer climate business areas where perceived risk is high, such as energy storage, or where aggregation models are unfamiliar in a developing-country context. Governments can increase their efforts to reduce risk (for example, by blending public and private finance), while also helping to aggregate smaller, de-risked assets, diversified across sectors and geographies, to attract institutional investors.

Both reports highlight the need for public dollars to prime the pump for private investment in clean energy. This exactly the role of Green Banks!

Green Banks have a proven history of doing exactly what these reports call for—deploying public capital to de-risk and increase private investment in clean energy projects. Examples of successful Green Banks include the Connecticut Green Bank, NY Green Bank, UK Green Investment Bank, Rhode Island Infrastructure Bank, and the Australian Clean Energy Finance Corporation—each Green Bank has used public dollars to increase private investment in clean energy. And by leveraging more private investment, Green Banks increase the impact of each public dollar devoted to deploying clean energy.

Green Banks are an important and effective tool in climate and energy finance. Global thought leaders clearly understand the value of the Green Bank approach. Now the institutional model needs to be spread around the world. This coming week, NRDC will hosting an event on Green Banks at COP22 in Morocco, and CGC will be speaking about Green Banks at an IDB-hosted conference in Lima on innovative finance.

Green Banks are an important and effective tool in climate and energy finance. Global thought leaders clearly understand the value of the Green Bank approach. Now the institutional model needs to be spread around the world. This coming week, NRDC will hosting an event on Green Banks at COP22 in Morocco, and CGC will be speaking about Green Banks at an IDB-hosted conference in Lima on innovative finance.

Many Pathways to Creating a Green Bank

By Coalition for Green Capital

The question CGC is asked most often by policymakers and Green Bank supporters is, “How do you actually create a Green Bank?” The truth is that there is no right answer or single approach. The correct path depends on the specific fiscal, economic, political and institutional circumstances of the given market. And the form the Green Bank takes, and its sources of funding are not always the same.

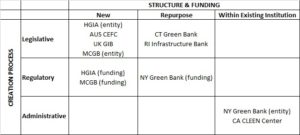

This means there are several mechanisms for creating & funding Green Banks, and there are several types of Green Bank forms and funding sources. The common mechanisms are regulation, legislation, and administrative/executive action. There are also three general categories of how to structure and fund a Green Bank: create a new structure or new source of funds, repurpose an existing structure or source of funds, or place a Green Bank within an existing institution and use its funds.

When it comes to creating and capitalizing a Green Bank, different pathways make sense for different situations. We’ve created the below chart as a way of visualizing the possibilities!

Green Banks in chart:

- Australia’s Clean Energy Finance Corporation (CEFC)

- California Lending for Energy and Environmental Needs (CLEEN) Center

- Connecticut Green Bank (CGB)

- Hawaii Green Infrastructure Authority (HGIA)

- Montgomery County Green Bank (MCGB)

- New York Green Bank (NY Green Bank)

- Rhode Island Infrastructure Bank (RIIB)

- United Kingdom Green Investment Bank (UK GIB)

Op-Ed on Investing in Energy Infrastructure

By Coalition for Green Capital

Our CEO (and former FCC chairman) Reed Hundt published an opinion piece in TechCrunch arguing for a huge increase in private and public investment in clean energy infrastructure in addition to roads and bridges. Using blended financing techniques to update energy infrastructure, he claims, will benefit businesses, individuals and the environment.

By Coalition for Green Capital

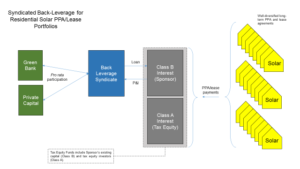

Last month NY Green Bank (NYGB) closed on a $37.5 million investment in residential solar, which was part of a larger $313.0 million syndicated credit facility to Vivint Solar. Through this financing, NYGB and its private investment counterparties have enabled Vivint Solar to recapitalize so that it may complete more residential rooftop solar leases/PPAs in the future. This provides critical liquidity to the residential solar market and increases overall capital market efficiency.

This transaction is similar to one NYGB completed earlier this year with Sunrun, where NYGB also lent money alongside private sector funders to provide the developer more capital to complete projects. Transactions like this ensure the continued success of the third-party-owned residential solar financing model and further demonstrate to private investors the financial strength of distributed clean energy investments at scale.

In the Vivint Solar transaction, an existing warehouse credit facility was refinanced by a term loan provided by NYGB and other syndicate banks. Under this structure, the residential solar developer enters into a credit facility to aggregate and hold completed projects until the value of the portfolio is large enough to attract larger institutional capital investments. The initial financing includes tax equity, where certain investors provide necessary capital in exchange for the tax credits produced by the underlying projects. It also includes debt that is behind the tax equity investor in payment priority and is thus referred to as back-leverage. Once this credit facility is entirely used, the developer cannot continue to deploy new solar without finding new capital. This is where the syndicated term loan comes in. The proceeds from the loan are used to refinance the existing back-leverage freeing up capacity in the warehouse credit facility to attract additional tax equity investment and further deployment of residential solar projects.

Figure 1: NYGB Back Leverage for Residential Solar Transaction Chart Provided by NYGB

In the case of this specific transaction, Vivint Solar had a portfolio of 307 MW of residential solar, and it sought a syndicate of multiple lenders to refinance the portfolio. NYGB saw value and need to participate, as a significant portion of that portfolio was located in New York State, and providing support to Vivint Solar would encourage Vivint Solar’s continued building of New York projects. It is estimated that $167 million in new projects will be built in New York as a result of the liquidity provided by this transaction.

The particulars of the deal are below, and are also available in NYGB’s transaction profile:

- NYGB provided $37.5 million as a part of a debt syndicate with several other lenders that provided a five-year $313.0 million credit facility to Vivint Solar as take-out financing for a portfolio of 307 MW of residential solar assets.

- 4 MW of that solar is expected to be located in New York State, valued at $167.0 million of New York-based clean energy assets.

- Vivint Solar uses the cash flows from its existing portfolio of long-term residential solar leases and PPAs to service the debt.

- By using the proceeds to refinance its warehouse credit facility, Vivint Solar is able to develop more projects and build up another large portfolio.

- NYGB and the other private investors in the debt syndicate all invested on the same terms, and get returns from the investment on a pro rata

The long-term expectation is that in five years when the loan term is completed (and when the ITC recapture period has ended) the syndicated loan will be taken out by long-term financing. This helps illuminate the full financing lifecycle for residential rooftop solar projects, and the critical market gap NYGB is filling by participating in this transaction.

In providing much-needed liquidity and innovative capital solutions to the clean energy market, NYGB has elegantly demonstrated the valuable role a Green Bank can play in a clean energy market. And, as a founding member of the Green Bank Network, NYGB is well-positioned to share its expertise and best practices with other Green Banks.

Green Bankers Gather in Tokyo

By Coalition for Green Capital

This week, Green Bank representatives and clean energy finance leaders will gather in Tokyo to share experiences and identify ways that public and private investment can rapidly scale to meet climate change goals.

On Tuesday, the Japanese Green Finance Organisation (Japan’s Green Bank) will host the annual Green Bank Congress. Green Banks from Australia, UK, Connecticut and New York will be in attendance. They’ll be joined by thought leaders from Japan, other governments exploring Green Bank creation, and the Green Climate Fund, which is considering its own role in the Green Bank landscape. And on Wednesday the Green Bank Network (GBN) will hold its first member-wide meeting, where members will lay out plans for how the Network can enhance Green Bank practices around the world in 2017.

Then on Thursday and Friday, the OECD will host its third annual Green Investment Financing Forum (GIFF), a gathering of policymakers, institutional investors, multilateral development banks, and Green Banks to share best practices around innovative clean energy investment practices. Prior GIFFs, held the last two years in Paris, have focused on Green Bonds, Green Banks and other techniques for driving the massive amount of institutional capital available, but currently on the side lines of climate investment. The Coalition for Green Capital will be leading and participating in all of these events, along with our GBN partners at NRDC.

Just last month, the leaders of the G20 announced a new commitment to green finance. Ma Jun, Chief Economist of the People’s Bank of China wrote, that the G20’s Finance Ministers, “have become increasingly convinced that ‘green finance’ – financing environmentally sustainable growth – should be at the center of economic-development strategies. And specifically, in regards to China he wrote that his nation, “must establish a national-level Green Development Fund, much like the United Kingdom’s Green Investment Bank.”

That means national Green Banks are now under development in the three largest emitting countries on the planet – China, the United States and India. With representatives of all three nations in attendance this week in Tokyo, the global conversation on Green Banks and green finance has never been so important.

Please look for on-going reporting from this week’s Green Bank events in Tokyo.

By Coalition for Green Capital

Yesterday, Senator Chris Murphy (D-CT) and Senator Richard Blumenthal (D-CT) led a roundtable discussion of the National Green Bank Act of 2016. The senators are two of the co-sponsors of the legislation, alongside Senator Sheldon Whitehouse (D-RI). Representative Chris Van Hollen (D-MD) has been the lead sponsor in the House of Representatives.

The session was hosted by the Yale Center for Business and the Environment, and included Bryan Garcia, President and CEO of the Connecticut Green Bank and Jeffrey Schub, Executive Director of the Coalition for Green Capital.

With Election Day just a few weeks away, the discussion focused on the bill’s prospects in a divided Congress. The senators cited the rapid growth of clean energy investment, the Paris climate agreement, and the national focus on infrastructure as reasons why this is a ripe moment for national Green Bank creation.

Hillary Clinton has outlined a plan to put about $250 billion into infrastructure….if you’re talking about a major play on infrastructure, [the National Green Bank] would be part of that conversation. – Senator Chris Murphy

As we’ve written about previously, the discussion of a national infrastructure bank makes this legislation particularly timely. For all of these reasons, the senators said they expected the idea of a National Green Bank to ultimately receive bipartisan support. Senator Blumenthal called the National Green Bank a “winner that crosses the aisle, that crosses disciplines, that crosses geographies.”

Watch the full session

Follow

The Clean Energy Future Blog

for links, analysis, and commentary on the world of green banks and clean energy investment