Last month NY Green Bank (NYGB) closed on a $37.5 million investment in residential solar, which was part of a larger $313.0 million syndicated credit facility to Vivint Solar. Through this financing, NYGB and its private investment counterparties have enabled Vivint Solar to recapitalize so that it may complete more residential rooftop solar leases/PPAs in the future. This provides critical liquidity to the residential solar market and increases overall capital market efficiency.

This transaction is similar to one NYGB completed earlier this year with Sunrun, where NYGB also lent money alongside private sector funders to provide the developer more capital to complete projects. Transactions like this ensure the continued success of the third-party-owned residential solar financing model and further demonstrate to private investors the financial strength of distributed clean energy investments at scale.

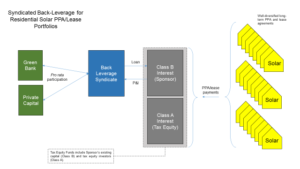

In the Vivint Solar transaction, an existing warehouse credit facility was refinanced by a term loan provided by NYGB and other syndicate banks. Under this structure, the residential solar developer enters into a credit facility to aggregate and hold completed projects until the value of the portfolio is large enough to attract larger institutional capital investments. The initial financing includes tax equity, where certain investors provide necessary capital in exchange for the tax credits produced by the underlying projects. It also includes debt that is behind the tax equity investor in payment priority and is thus referred to as back-leverage. Once this credit facility is entirely used, the developer cannot continue to deploy new solar without finding new capital. This is where the syndicated term loan comes in. The proceeds from the loan are used to refinance the existing back-leverage freeing up capacity in the warehouse credit facility to attract additional tax equity investment and further deployment of residential solar projects.

Figure 1: NYGB Back Leverage for Residential Solar Transaction Chart Provided by NYGB

In the case of this specific transaction, Vivint Solar had a portfolio of 307 MW of residential solar, and it sought a syndicate of multiple lenders to refinance the portfolio. NYGB saw value and need to participate, as a significant portion of that portfolio was located in New York State, and providing support to Vivint Solar would encourage Vivint Solar’s continued building of New York projects. It is estimated that $167 million in new projects will be built in New York as a result of the liquidity provided by this transaction.

The particulars of the deal are below, and are also available in NYGB’s transaction profile:

- NYGB provided $37.5 million as a part of a debt syndicate with several other lenders that provided a five-year $313.0 million credit facility to Vivint Solar as take-out financing for a portfolio of 307 MW of residential solar assets.

- 4 MW of that solar is expected to be located in New York State, valued at $167.0 million of New York-based clean energy assets.

- Vivint Solar uses the cash flows from its existing portfolio of long-term residential solar leases and PPAs to service the debt.

- By using the proceeds to refinance its warehouse credit facility, Vivint Solar is able to develop more projects and build up another large portfolio.

- NYGB and the other private investors in the debt syndicate all invested on the same terms, and get returns from the investment on a pro rata

The long-term expectation is that in five years when the loan term is completed (and when the ITC recapture period has ended) the syndicated loan will be taken out by long-term financing. This helps illuminate the full financing lifecycle for residential rooftop solar projects, and the critical market gap NYGB is filling by participating in this transaction.

In providing much-needed liquidity and innovative capital solutions to the clean energy market, NYGB has elegantly demonstrated the valuable role a Green Bank can play in a clean energy market. And, as a founding member of the Green Bank Network, NYGB is well-positioned to share its expertise and best practices with other Green Banks.