The Solar and Energy Loan Fund (SELF) recently reached a significant milestone: they deployed more than $30 million in financing for green home upgrades, with 74% going to low and moderate-income populations –and 60% to those with low credit scores.

A member of the American Green Bank Consortium, SELF has established a successful 12-year track record helping more than 9,000 people and has leveraged its original $3 million grant by a 13:1 margin. Proving that a low credit score does not equate to un-creditworthiness, nearly all loans have been repaid to SELF – the default rate is only 2%.

“We are the only green community development financial institution (CDFI) whose mission is to rebuild and empower communities through providing access to affordable capital for clean energy and climate resilient housing development and home upgrades,” said Duanne Andrade, executive director of SELF. “We started by creating a home improvement program for single-family homeowners to access clean energy, and have since grown to provide energy efficiency programs for landlords, developers, and small businesses. And very early on, we were among the first lenders to consider climate resiliency projects as part of clean energy and energy efficiency financing.”

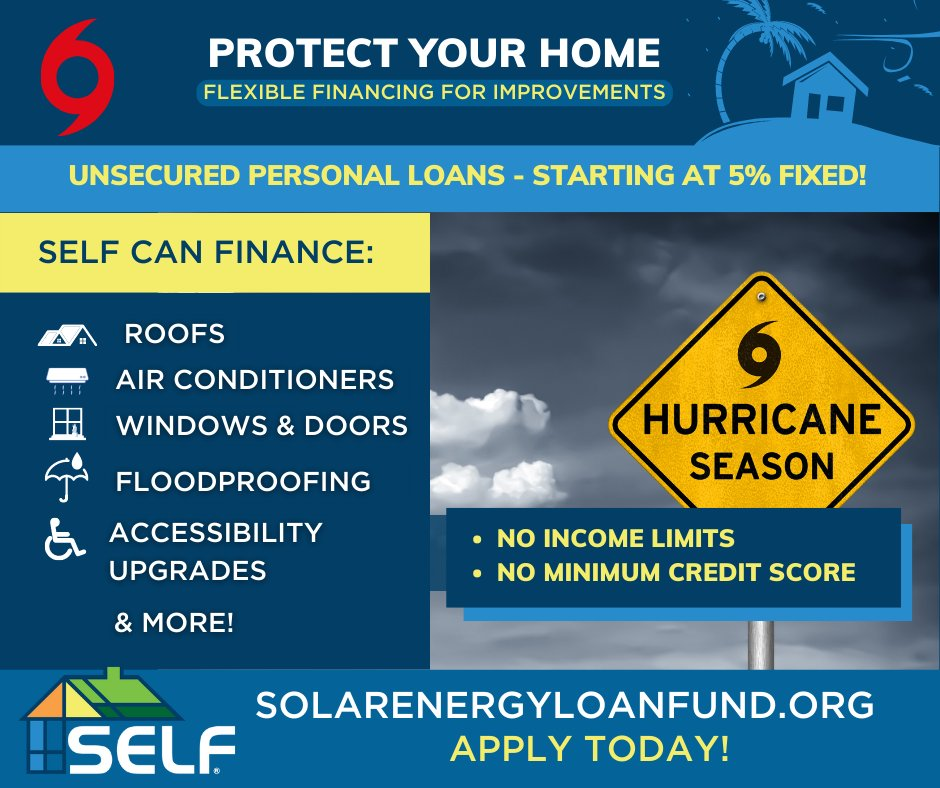

SELF is a dual green bank and CDFI that is providing affordable, unsecured loans for clean energy and climate-resilient home improvements coupled with access to a network of pre-vetted contractors and technical assistance, throughout the Southeast. With a focus on low- and moderate-income populations, SELF is leading the way in advancing climate equity, financial inclusion and reducing carbon emissions in states such as Florida; Georgia; Alabama; South Carolina; Tennessee; and Texas.

Ms. Andrade stresses that SELF takes a triple-bottom-line approach, focusing on social, environmental, and economic impacts. These are maximized when making capital accessible to those who are not typically afforded the opportunity.

“We allow funding for roof repair, hurricane shutters, impact windows and doors because we understand the holistic approach that is required to serve low-and-moderate income communities,” she said. “By helping communities that are most impacted by climate events protect their homes and maintain their safety and well-being, we are also advancing financial inclusion, climate equity and ultimately reducing carbon emissions.”

Beyond offering a range of home improvement options, SELF also helps protect families and people by connecting them with a network of nearly 1,000 vetted contractors.

LEVERAGING EPA’S GREENHOUSE GAS REDUCTION FUND

The Coalition for Green Capital and SELF recently announced the formation of a new strategic partnership. SELF joined a growing consortium of clean energy lenders and investors seeking to leverage funds from the Environmental Protection Agency’s (EPA) Greenhouse Gas Reduction Fund (GGRF) to launch a nationwide green bank. The coalition anticipates an initial pipeline of clean energy projects valued at $13B in public-private dollars over the next several years.

“SELF has long worked with CGC and we’re excited to partner on implementing the highly successful green bank model at a national scale,” said Andrade. “Providing affordable and accessible financing in low-income and disadvantaged communities to ensure an equitable transition to a clean energy economy, is at the heart of the work we do. The national green bank will provide a much-needed source of low-cost and flexible funding with technical assistance that will unlock opportunities to achieve our overarching goal of climate equity.”

Pointing to SELF’s success in raising capital and leveraging it to support clean energy investments, Ms. Andrade noted that they are prepared to grow their deployment plans and access new funding provided by the GGRF. “We have raised $40 million in capital directly, and that is unlocking at least $150 million in projects right now, and it’s going to be more,” she said.

She also stressed the need for inclusivity in the deployment of GGRF funds, stating that “the more inclusive we are in terms of participating and deploying the funds, the greater impact and better sustainable and long-term results we will achieve for everybody.”

REACHING UNDERSERVED COMMUNITIES

Ms. Andrade highlights that SELF’s mission is not only to address the climate crisis and reduce emissions, but also to deliver solutions that are inclusive and accessible to underserved populations and to support sustainable job creation.

“The only way we’re going to reduce greenhouse gas emissions, which is the final goal, is by making the clean energy economy inclusive,” she said. “We cannot achieve the goal of carbon emission reductions if we leave out 40% of low-and-moderate income Americans.”

One of SELF’s major innovations is its underwriting method, which allows them to provide affordable access to capital to people with poor credit, who are underbanked and those who are typically denied access to credit through traditional methods.

As Ms. Andrade explained, “We created an underwriting method that is based on a person’s ability to repay, not their credit score. We’re able to offer affordable loans to everyone including people with no credit or low scores, proving that the traditional system typically undermines people who are indeed creditworthy by overly relying on their credit scores.”

SELF’s investments not only expand access to capital but also provide a better quality of life for underserved communities and improve climate resiliency for entire neighborhoods. SELF reports an average of 24% savings on energy bills for families who make energy efficiency upgrades. Additionally, their climate resilience improvements, such as replacing an old roof, can help families access insurance, which is becoming increasingly difficult for low- and moderate-income populations in states that are affected by hurricanes.

LEADING CLIMATE RESILIENCY EFFORTS ACROSS THE SOUTH

While the organization is widely recognized for its work in Florida, SELF is also leading climate resiliency efforts across the South, with a focus on helping low- and moderate-income families in Georgia; Alabama; South Carolina; Tennessee; and Texas.

“We know that the Southeast region of the US is particularly vulnerable to climate change and natural disasters, and we are committed to providing the necessary resources and support to help these communities adapt and become more resilient,” said Ms. Andrade.

Ms. Andrade also highlighted the importance of inclusive solutions for different regions and the need for local grassroots organizations to lead the way. “The national policy landscape is not equal nor is it homogeneous,” she said. “It is very diverse and we need different solutions for different regions. And those solutions should come from the local grassroots organizations that know best what is needed.”

In addition to funding green home improvements, SELF recently launched the SAGE HOMES Fund to spur the development of affordable, climate-resilient housing. The Fund, which was made possible by a $3 million investment from JPMorgan Chase & Co., supports minority and novice developers. It provides flexible capital and technical assistance to fill financial gaps and catalyze new development.

“We are especially excited about the new SAGE program which will prioritize the inclusion of developers and landlords of color in the creation of climate-resilient, affordable housing,” said Ms. Andrade. “SAGE will support projects led by community members, for community members with a focus on minority, Black, Latino, and female-led midsize affordable housing developments. We are eager to begin this work in South Florida, with the goal of scaling our model across the Southeast.”