Senator Coons (D-Delaware) has just announced that he will be introducing the Master Limited Partnership Parity Act. This Bill would level the playing field for renewable energy investors by enabling them to adopt a corporate structure that currently gives tax advantages to fossil-fuel investors.

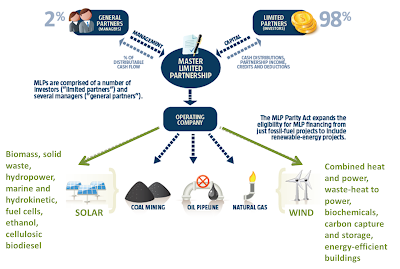

A master limited partnership (MLP) is a business structure that is taxed as a partnership but whose ownership interests are traded like corporate stock on a market. Publicly traded C-corporations are taxed at the corporate and the shareholder level. An MLP, however, avoids this double taxation since the corporation is treated as a partnership and only the shareholders are taxed. The MLP  consists of limited partners (investors) and general partners (managers). The numerous limited partners receive quarterly distributions (equivalent to dividends paid to C-corp shareholders) in return for providing capital. Whereas the limited partners play no role in the management of the MLP, the general managers (usually in the form of another company or a group of individuals) have full control of daily operations and typically hold 2% ownership stake. Historically, many MLPs have offered investors stable returns around 6-7%.

consists of limited partners (investors) and general partners (managers). The numerous limited partners receive quarterly distributions (equivalent to dividends paid to C-corp shareholders) in return for providing capital. Whereas the limited partners play no role in the management of the MLP, the general managers (usually in the form of another company or a group of individuals) have full control of daily operations and typically hold 2% ownership stake. Historically, many MLPs have offered investors stable returns around 6-7%.

Given the attractiveness of the MLP structure, why hasn’t it been able to aid the renewable industry in the past? The catch is that MLPs must get at least 90% of their income from “qualified sources.” Historically, qualified sources have included real estate or natural resources such as crude oil, petroleum products, coal, timber, and other minerals. According to Section 613 if the federal tax code, qualified energy sources must come from depletable sources. $320 billion of the $445 billion in the aggregate MLP capital market have gone into midstream oil and gas pipeline projects.

The MLP Bill will expand the definition of “qualified resources” to include clean energy sources and infrastructure projects including wind, closed and open loop biomass, solar, municipal solid waste, hydropower, marine and hydrokinetic fuel cells, and other clean fuel sources. By extending the MLP benefits to clean energy and infrastructure projects, the Bill will:

- Attract more investors to the clean energy market with relatively low but stable dividends, while reducing project financing costs by up to fivefold

- Increase the federal tax base because new markets will be opened to investors will have to pay taxes

- Bring more total renewable energy and infrastructure projects online

- Enable more Americans to benefit from investments in clean energy because the current tax breaks (Investor Tax Credit and accelerated depreciation) only benefit wealthy entities such as large banks and corporations with huge tax burdens

CGC has a multifaceted mission statement and collaborates on a wide variety of initiatives. However, one raison d’être not to be overlooked is our mission to advocate for tax and finance policies that support investment in energy efficiency and clean energy. CGC is a proud supporter of Senator Coons’ Master Limited Partnership Parity Act and hopes you will be too.

If you or your organization would like to support the Bill please contact CGC for more information by emailing coalitionforgreencapital@gmail.com