The track record shows that a Green Bank can drive more investment, more clean energy, and more CO2 reduction per dollar of public cost than current programs.

The longest running Green Banks in the U.S. have now been operating for over five years. Green Banks have driven over $2 billion of clean energy investment in the U.S., and $26 billion globally as of 2016. Collectively those Green Banks have driven more than $3 of private investment per each $1 of public investment used.

But, now that the track record exists, it is important to ask if Green Banks really are accomplishing good outcomes and getting value for public money. Should policymakers invest public money in Green Banks?

A simple way to answer that question is to compare Green Bank outcomes to those of what can be considered the “benchmark” policy for clean energy investment across the country – utility efficiency incentive programs. Utilities use ratepayer and public funds across the country to offer nearly $8 billion per year through incentive programs to spur demand for efficiency and “procure least cost resources.” Regulators direct utilities to operate these programs to reduce overall energy demand and defer construction of new generation capacity.

Green Banks are intended to achieve similar (though slightly different) energy, economic and environmental outcomes. They seek to maximize the deployment of affordable clean energy (renewable and efficiency) and maximize total investment (both public and private). Green Banks use a range of financing techniques and program design structures to draw in capital and make markets grow.

Incentives and Green Banks are complementary and often are used together in the same project. Cash grants and rebates can entice demand, and financing can enable would-be adopters to buy clean energy technology with no upfront cost. It is not an either/or. Since incentive programs exist everywhere, though, they provide a useful basis of comparison of what energy, economic and environmental outcomes can be achieved with public investment.

The best point of comparison is Connecticut, whose Green Bank has operated for over five years. And because the Green Bank was capitalized by re-directing a small portion of the funds previously used for incentives, the state provides a test case for Green Bank evaluation.

The case for Green Banks is clear. On many energy, economic and environmental metrics, the Connecticut Green Bank has superior outcomes.

- In the three years from 2014 to 2016, the CT Green Bank has saved or generated 50% more clean energy per dollar of public cost than the incentive programs. Even if the Green Bank lost every dollar it loaned (turning that loan into a cost), the Green Bank would still perform on par with incentive programs.

- And the Green Bank has reduced 50% more CO2 emissions per dollar of public cost than incentives. Again, even if the Green Bank lost every dollar it loaned, the Green Bank would still perform as well as the incentive programs.

- Green Banks leverage more private clean energy investment per dollar of public investment than the incentive programs. Over the last three years, the Green Bank leveraged $4.65 of private investment per dollar of public investment, compared to only 90 cents of private investment for incentive programs.

- The Green Bank also puts more of its money into project investment rather than operating expenses. Over the last three years, only 25% of the funds used by the Green Bank went to operating expenses. For the utility incentives, this figure is 34%.

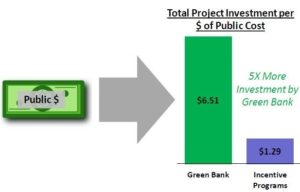

- The higher leverage and operating efficiency means that the Green Bank drives 5x more clean energy investment per dollar of public cost than the incentive programs.

- In addition to realizing greater energy, environmental and investment outcomes, the Green Bank has actually paid dividends to the state. The Green Bank has paid $25.4 million to the state government to fill budget shortfalls. This is possible because the Green Bank preserves capital by offering financing. Incentive programs cannot make these kinds of direct cash dividends.

By these measures of capital efficiency and outcomes, Green Banks represent a strong and wise investment of public funds. And policymakers around the country can realize similar benefits by creating and funding their own Green Banks.

As stated before, Green Banks and incentives are complementary. There need not be a debate between financing versus subsidies (though some organizations continually want to force that debate). But a data-driven analysis shows us that Green Banks can clearly improve the energy, economic and environmental outcomes any state aims to achieve through public investment in clean energy deployment.