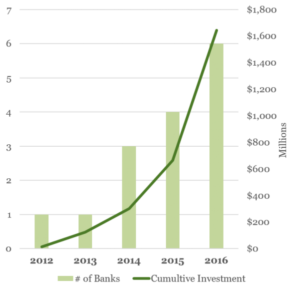

Since the first Green Banks in the US were founded, the number and investing pace of these institutions has ramped up.

Since the first Green Banks in the US were founded, the number and investing pace of these institutions has ramped up.

CGC reviewed annual reports and transactions at six US-based Green Banks from their inception through fiscal year 2016. At the end of 2016, the transactions these institutions participated in represented more than $1.6 billion of cumulative clean energy investment. Nearly $1 billion of that total came from private sources, demonstrating the continuing ability of Green Banks to leverage private dollars.

The investment pace is poised to accelerate in fiscal year 2017. Last month NY Green Bank announced the close of 13 transactions, totaling over $900 million. This set of transactions alone places total investment well over the $2 billion mark.

The six Green Banks reviewed were: the California Lending for Energy and Environmental Needs (CLEEN) Center, the Connecticut Green Bank, the Hawaii Green Energy Market Securitization (GEMS) Program, the Montgomery County Green Bank, the NY Green Bank, and the Rhode Island Infrastructure Bank.