What is a Green Bank

What are Green Banks?

Green Banks are mission-driven institutions that use innovative financing to accelerate the transition to clean energy and fight climate change.

Being mission-driven means that Green Banks care about deploying clean energy rather than maximizing profit. They actively develop a pipeline of clean projects and seek out opportunities in the market. All Green Banks have the mission to address climate change, though many also have additional objectives such as improving resiliency or addressing underserved markets.

Establishment as institutions means that green banks are durable and can build up organizational culture and expertise. They have the autonomy to be flexible and responsive to the real world. In contrast to programs, institutions may try something, fail, and then try something different.

All Green Banks have the mission to address climate change, though many also have additional objectives such as improving resiliency or serving low-income communities.

Green banks use financing, not grants. Financing means that capital is eventually expected to be returned or repaid, and this helps to maximize the impact of each dollar that a green bank deploys. Because of this approach, green banks focus on markets where there is potential for payback. This generally means proven, technically viable projects that are well past the research and development stage. Financing can be done in tandem with other market development activities.

With their focus on accelerating the clean energy transition, green banks have timing in mind. They aim to maximize market penetration as quickly as possible in order to displace dirty energy. This is in contrast to passively making capital available as some existing programs do.

Green banks have timing in mind. They aim to maximize market penetration as quickly as possible in order to displace dirty energy.

Ultimately, green banks aim to fight climate change. We have a short window to accomplish the clean energy transition if we are to avoid the worst impacts. The accelerated adoption of clean energy facilitated by a green bank is a powerful and cost-effective part of a full climate policy platform.

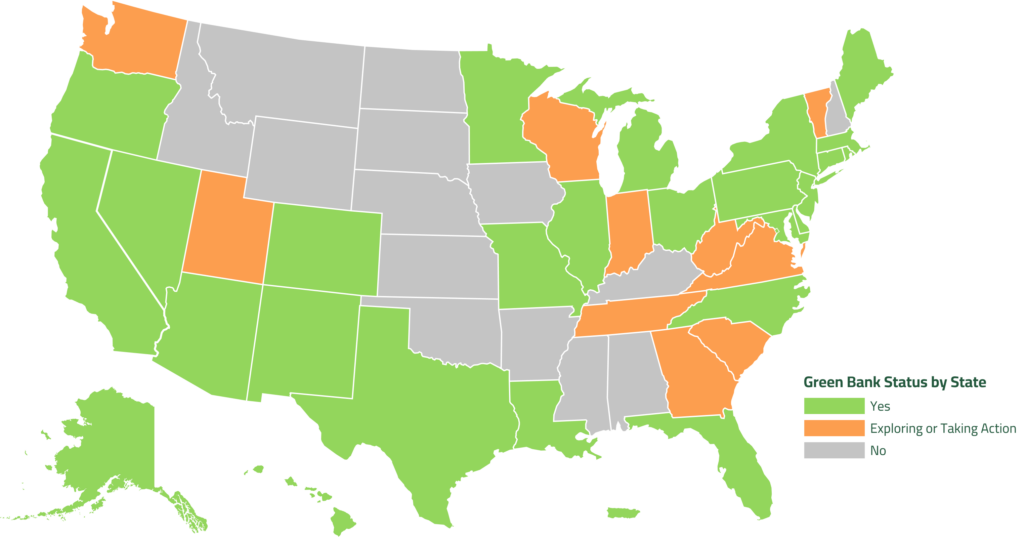

Green Bank Status by State

| State | Organization | Green Bank Type |

|---|---|---|

| Alaska | Spruce Root | Non-profit |

| Arizona | Groundswell Capital | Non-profit |

| California | CAEATFA | Public |

| California | California Infrastructure Bank | Quasi-Public |

| California | California Pollution Control Financing Authority (CPCFA) | Public |

| Colorado | Colorado Clean Energy Fund | Non-profit |

| Connecticut | Connecticut Green Bank | Quasi-Public |

| DC | DC Green Bank | Non-profit |

| Delaware | Energize Delaware | Non-profit |

| Florida | Solar and Energy Loan Fund of Florida | Non-profit |

| Georgia | Atlanta Development Authority d/b/a Invest Atlanta | Non-profit |

| Hawaii | Hawaii Green Infrastructure Authority | Quasi-Public |

| Illinois | Illinois Finance Authority/Climate Bank | Quasi-Public |

| Indiana | Indiana Energy Independence Fund | Non-profit |

| Louisiana | Finance New Orleans | Quasi-Public |

| Louisiana | Louisiana Clean Energy Fund | Non-profit |

| Maine | Efficiency Maine Trust | Quasi-Public |

| Maryland | Climate Access Fund | Non-profit |

| Maryland | Maryland Clean Energy Center | Quasi-Public |

| Maryland | Montgomery County Green Bank | Non-profit |

| Massachusetts | Massachusetts Clean Energy Center | Public |

| Massachusetts | Massachusetts Housing Finance Authority & Massachusetts Community Climate Bank | Public |

| Michigan | Michigan Saves | Non-profit |

| Missouri | Environmental Improvement and Energy Resources Authority (EIERA) | Quasi-Public |

| Missouri | Missouri Green Banc | Non-profit |

| Nevada | Nevada Clean Energy Fund | Non-profit |

| New Jersey | New Jersey Economic Development Authority | Public |

| New Mexico | New Mexico Climate Investment Center | Non-profit |

| New York | New York City Energy Efficiency Corporation (NYCEEC) | Non-profit |

| New York | NY Green Bank | Public |

| North Carolina | North Carolina Clean Energy Fund | Non-profit |

| Ohio | Columbus Region Green Fund | Non-profit |

| Ohio | GO Green Energy Fund (Growth Opps) | Non-profit |

| Ohio | Ohio Air Quality Development Authority | Quasi-Public |

| Pennsylvania | Philadelphia Green Capital Corp. | Quasi-Public |

| Puerto Rico | Puerto Rico Green Energy Trust | Non-profit |

| Rhode Island | Rhode Island Infrastructure Bank | Quasi-Public |

| South Carolina | South Carolina Clean Energy and Resilience Accelerator | Non-profit |

| Texas | Clean Energy Fund of Texas | Non-profit |

| Utah | SustainEnergyFinance | Non-profit |

| National | Inclusive Prosperity Capital | Non-profit |

Green Banks Techniques

Financing is essential to rapid deployment of clean energy. Green Banks make it easier to finance projects in new markets, geographies and technologies that otherwise couldn’t be built. This mean cheaper and cleaner energy for customers and more investment for private capital providers.

The result is more clean energy being deployed at lower cost. Consumers save money, developers and investors get to build more projects, and dirty, polluting energy sources get replaced.

Learn more about the techniques green banks use to clear away financial barriers.

Resource Library

CGC has built up an extensive resource library with in-depth market analyses, green bank design studies, policy white papers, and other valuable tools for both domestic and international stakeholders.