A broad coalition of environmental organizations has long supported the creation of a single, national green bank, repeatedly calling for Congress to pass such legislation. Organizations representing communities from all over the country, from the Sierra Club to the Union of Concerned Scientists to the Chesapeake Climate Action Network to Energy Smart Colorado, have specifically named the national green bank as essential to tackling the climate crisis and directing clean energy investments to communities that have long borne the brunt of fossil fuel pollution.

In a letter to Congress, 20 of the leading national environmental organizations wrote that climate investments such as the national green bank, “put us on a clear path to cut climate pollution in half by 2030 by creating new clean energy tax incentives, transforming our power sector to achieve 100% clean electricity and investing in communities too often left behind. Anything less fails the Climate Test that science and this moment demand.”

ROLE OF ENVIRONMENTAL ORGANIZATIONS IN THE NATIONAL GREEN BANK “BIG TENT”

The Coalition for Green Capital hosted a webinar yesterday for dozens of environmental organizations to discuss the launch of the national green bank and next steps for facilitating their participation in the “Big Tent” that, with capital of $20 billion, will cause up to $250 billion of clean power platform investments to be made over the next 10 years.

Sam Ricketts, co-founder and co-director of Evergreen Action, said, “I’m really excited to see the EPA utilize these dollars to support an ecosystem of finance throughout the entire country, building from the proven models of state and local green banks… The other thing that I’m most excited about when it comes to implementation is the ability to invest in and catalyze investment in projects that are going to reduce greenhouse gas pollution, and also build wealth in disadvantaged communities and drive real, sustainable, and equitable finance with projects. This is one of the investments in the IRA that’s most exciting because of its ability to catalyze, as existing financial institutions are already doing, in disadvantaged communities and in environmental justice communities, new clean energy projects.”

Damon Burns, president and CEO of Finance New Orleans, highlighted the collective strength of the green bank network saying, “At the end of the day, we’re all trying to accomplish the same goals, which is to stimulate and accelerate the adoption of climate technology on the ground, in our community so that it can create real impact… That’s what’s unique about the green bank network, everybody is interested in building up the industry. This is not a competitive thing… We will be able to leverage the platforms of other green banks so that we can accelerate our process, which will accelerate investments in our community, and vice versa… So green banks represent an avenue and an opportunity. We’re happy to be a part of this conversation and happy to be part of the network. We’re looking forward to scaling our programs not alone, but with this network and with the movement in mind.”

DRIVING INVESTMENTS TO LOW-INCOME AND DISADVANTAGED COMMUNITIES

The national green bank’s ability to direct investments to communities that need it most is widely recognized and is a key feature that experts say will be necessary as we make the transition to a clean energy economy.

REDUCING GREENHOUSE GAS EMISSIONS

Other organizations have noted the unprecedented progress that a national green bank would make in the fight to reduce greenhouse gas emissions.

“Reaching net-zero emissions by 2050 will call for a historic deployment of public and private finance for urgent, bold, and ambitious climate action,” said Ryan Fitzpatrick, Director of the Climate and Energy Program at Third Way. “The Clean Energy and Sustainability Accelerator Act of 2021 answers that call and is a major step in the right direction to provide low-cost capital and catalyze private investment for clean energy technology and infrastructure. We also commend the requirement to target 40% of its investment in climate-impacted communities. It makes more sense than ever to invest heavily in clean energy to create quality jobs, increase American competitiveness, and support those on the frontlines of the climate crisis.”

The Maryland Clean Energy Center last year reported, “Analyses of the Accelerator have concluded the initiative could generate $884 billion of total investment and deliver cumulative greenhouse gas emissions reductions of 2.5 billion metric tons over the course of a decade. By 2030, the Accelerator could deliver one-fifth of the emissions reductions needed for the United States to reach net-zero emissions by 2050.”

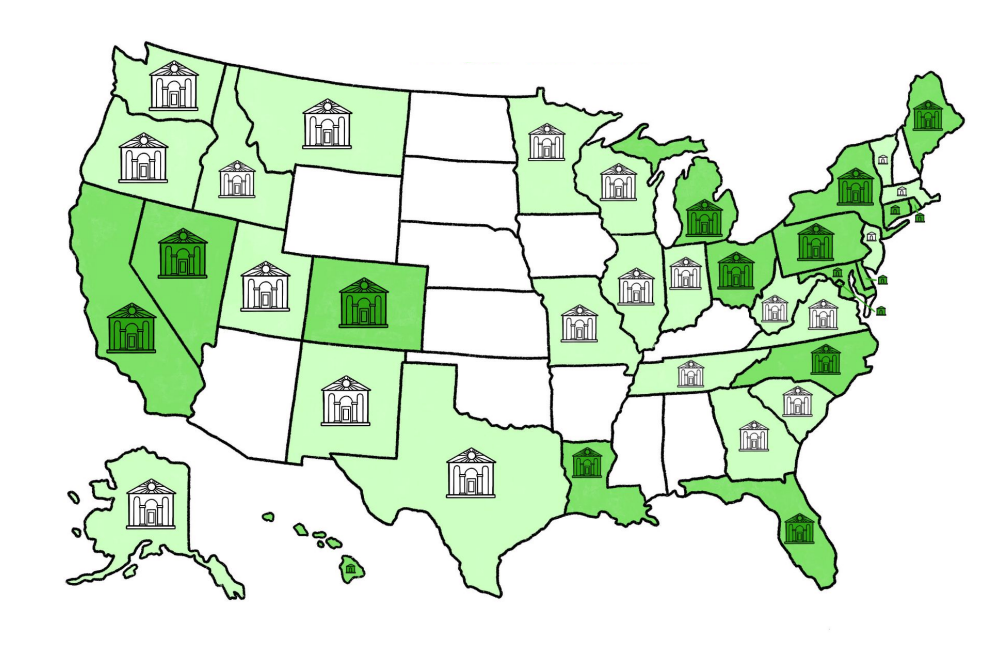

STRONG EXISTING NETWORK OF GREEN BANKS

Some organizations have seen the successes of the green bank model through the ongoing work of the existing network of state and regional green banks. When enacted, a national green bank would provide direct support to these local green banks and other community finance organizations to catalyze public-private partnerships and maximize every investment.

As the EPA considers how to deploy the $27 billion fund established by the Inflation Reduction Act, an existing network of green banks and community financial institutions is prepared to support the creation of the national green bank, as intended by Congress. A single, national green bank would actually expand the number of entities that would benefit from the funding and will have the ability to continually expand the network of new or existing entities that receive funds.