The Clean Energy Future Blog

Cleveland Plain Dealer: $30M investment could double solar energy in Cuyahoga County in five years

By Coalition for Green Capital

CLEVELAND, Ohio – Creating an investment fund of at least $13 million from public and philanthropic sources could help double the amount of solar power generated in Cuyahoga County in five years, according to a study financed in part by the county government.

Read the story.

By Coalition for Green Capital

This past week marked a significant milestone for the Colorado Clean Energy Fund – Colorado’s fledgling nonprofit Green Bank – as it closed its first transaction.

This also marks a momentous occasion for the Coalition for Green Capital (CGC). In 2017, CGC embarked on a multiyear partnership with the Colorado Energy Office and the Department of Energy to identify an optimal pathway towards creating a Green Bank in Colorado. That partnership resulted in the incorporation of the Colorado Clean Energy Fund (CCEF) in December 2018. Since then, CGC has supported the startup activities of CCEF and worked with it to identify and develop its initial business lines. CGC is proud of its partnership with CCEF and it looks forward to continuing to work with CCEF to build off of this success.

By Coalition for Green Capital

The Colorado Clean Energy Fund recently partnered with Fort Collins Utilities that allows low-and moderate-income residents to obtain loans to upgrade their homes’ efficiency through the EPIC Homes program. EPIC Homes provides property owners in Fort Collins with affordable, long-term loans for home improvement projects, such as new HVAC, air sealing, windows, and ventilation systems. These projects reduce the utility bills and save customers money.

EPIC Homes plans to “find, finance, and fix” 10,000 energy inefficient single-family homes and rental properties in Fort Collins over the coming years.

This is particularly important for low-and moderate-income homeowners who pay a disproportionate amount of their household income on utility expenses, sometimes in excess of 10% of their total annual income. The Colorado Clean Energy Fund will seek to replicate this innovative program in utility territories across Colorado.

The mechanics of the EPIC Homes program are fairly simple: The participating property owner obtains an Energy Assessment (i.e. energy audit) and identifies a cost-effective energy improvement project, applies to Fort Collins Utilities for funding, and, once Fort Collins Utilities approves the scope of work and underwrites the borrower, the utility distributes the EPIC Home loan to a contractor to perform the work and the property owner repays the loan over time through a separate line item on his/her utility bill.

The benefits produced by EPIC Homes are even simpler: At the end of the day, this program saves property owners money by reducing their utility expenses and produces healthier and more comfortable living spaces. And, unlike traditional consumer lending products, EPIC Homes utilizes a more inclusive underwriting process that allows low-and moderate-income homeowners and renters to participate in the program, even if they do not have a perfect credit score.

Fort Collins Utilities borrowed money by leveraging the City’s borrowing capacity to support EPIC Homes. Fort Collins Utilities hoped to procure a 15-year loan so that it could, in turn, offer 15-year loan terms to EPIC Home customers, but this proved to be challenging. That is when the Colorado Clean Energy Fund stepped in. The Colorado Clean Energy Fund partnered with Fort Collins Utilities and helped to analyze the landscape of potential capital providers and, ultimately, identify, negotiate, and secure a 15-year loan from Vectra Bank. Looking ahead, the Colorado Clean Energy Fund will provide technical assistance and arrange the loan capital on behalf of utilities that are interested in offering EPIC Homes to their customers.

Eleven percent of Coloradoans spend more than 10% of their total annual income towards energy costs alone. Thirty percent of Coloradoans spend more than 5% of their total annual income on their energy bills. This is tragic, especially considering the rising costs associated with living in Colorado. This essentially means that in order to keep the lights on, many Coloradoan families will need to make difficult decisions, like whether they should pay for electricity or healthcare.

Stay tuned for a future blog about Colorado Clean Energy Fund’s plan to expand EPIC Homes across Colorado.

New Jersey Announces Funding for a Green Bank

By Coalition for Green Capital

New Jersey’s recently announced plan for allocating revenues from the Regional Greenhouse Gas Initiative (RGGI) places a state green bank front and center. The plan allocates funding across four initiatives, including the creation of a New Jersey Green Bank to “help drive improved energy efficiency and renewable energy uses in the industrial, commercial and institutional sectors.” There are considerable gains to be made. The 2018 Statewide Greenhouse Gas Emissions Inventory calculated that greenhouse gas emissions from space heating and other combustion sources in the commercial and industrial sectors alone were nearly equal to emissions from the electricity generation sector.

An estimated $80 million in annual RGGI funding is available, with 15% (or $12 million) allocated for the Green Bank. This meaningful commitment would enable a newly-formed green bank to achieve significant clean energy outcomes and spur economic development in the state. In committing RGGI funds as a capital source for a new green bank, New Jersey is joining the model of its neighbors. Both the Connecticut Green Bank and the New York Green Bank have been given RGGI funding in the past.

The RGGI plan notes that a “substantial focus” of the green bank will be on providing financing to historically underserved populations and projects that “create high-quality jobs for New Jerseyans seeking to benefit from the State’s clean energy transition.” Green banks in other states have been effective at achieving both of these outcomes through their innovative financing programs. Those lessons are more relevant now than ever before as the full impact of the Covid-19 crisis comes into focus. A million or more New Jerseyans may be out of work, many from industries that may not soon bounce back. The green bank can provide New Jerseyans with the new, better jobs of the future with good pay in safe condition. Construction of the state’s clean power platform requires people of all skills. Sales, customer service, marketing, engineering, contracting and other skills are needed, and the green bank can help connect these skill sets to projects.

The announcement of a funding mechanism builds on the steady progress that has been made towards realizing the green bank. As CGC previously wrote, the green bank concept has appeared across multiple reports and plans put forward by the state. Steps have already been taken to operationalize those plans. In March, the New Jersey Economic Development Authority (NJEDA) issued a Request for Information (RFI) seeking input from a wide range of parties to inform the design and formation of a new green financing mechanism. CGC has been active in the green bank conversation in New Jersey from the beginning, starting with a 2018 analysis of the clean energy finance opportunity in New Jersey produced by Environmental Defense Fund and CGC.

CGC applauds this next step in solidifying the green bank plan, and looks forward to continuing to support stakeholders in the state. Laying the green bank’s foundation now also puts New Jersey in prime position to receive funds from a proposed National Climate Bank, that would provide capital to both existing and new green banks.

Clean Energy jobs rank low on Covid Risk Scale

By Coalition for Green Capital

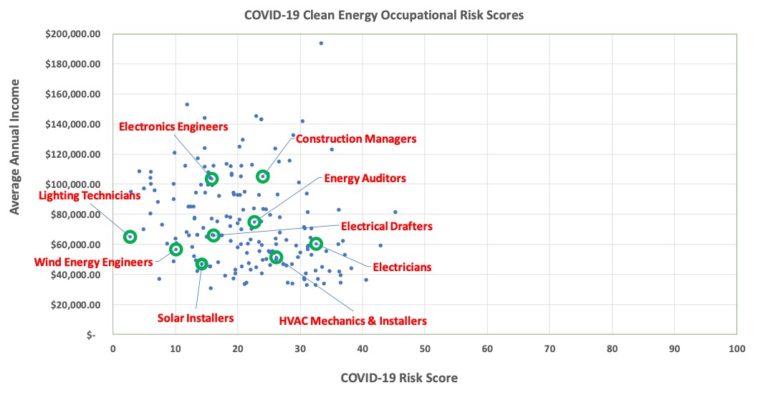

A new article and accompanying infographic from the Visual Capitalist rates and orders an extensive list of occupations based on their risk of exposure to COVID-19. The COVID risk score assigned to each occupation is between 0 and 100. The infographic includes only 100 of the most well-known occupations, but the article provides a more complete dataset comprised of nearly 1,000 occupations.

While some of the findings of this analysis are obvious (e.g. healthcare workers are at greater risk of exposure to the virus than economists), there are less obvious insights to be gleaned by analyzing the broader dataset. One of those insights is that there are dozens of occupations in the clean energy industry that fall within the top 25th percentile of safest occupations included in the Visual Capitalist’s analysis. These occupations include jobs ranging from Wind Energy Engineers (10.1 Risk Score) and Solar Photovoltaic Installers (14.3 Risk Score) to Surveyors (11.8 Risk Score), Construction and Building Inspectors (15.3 Risk Score), Technical Writers (15.8 Risk Score), Supply Chain Managers (20.6 Risk Score), and Public Relations Specialists (22.2 Risk Score).

In fact, out of the 1,000 occupations analyzed by the Visual Capitalist, more than 180 relate to clean energy in some manner. And all of these occupations fall within the top 50th percentile of the safest occupations included in the analysis. The visual below captures this information and highlights a few common positions in the clean energy industry.

Contained in the observation above is another potentially less obvious insight – the clean energy industry provides millions of jobs that extend far beyond engineering and contracting positions. As was noted in a recent paper of ours, Put Five Million Americans Back to Work Building Our Clean Power Future, the majority of jobs in the clean energy sector are in management, administrative, sales, and manufacturing positions, meaning Americans of all skillsets and backgrounds can find new work building the clean power future.

Considering that many of the jobs in industries that have been hit hardest by COVID-19 – i.e., hospitality, food service, and travel – may be lost forever, or at least may require a significant amount of time to return, it’s vital that we find opportunities to transfer those skillsets to other industries that are safer, can accommodate a diverse range of workers, and are engines of job creation – the clean energy industry is exactly that.

LSE US Center: How the federal government can learn from green bank innovation in the states

By Coalition for Green Capital

As concern about climate change continues to grow, so does interest in developing cleaner energy sources. Matthew J. Razzano looks at how some US states have created green banks, which aim to finance green projects by promoting private investment. Green banks in states like New York and Connecticut, he writes, could provide a road map for the federal government to create a nation-wide version.

Read Matthew’s full piece.

Follow

The Clean Energy Future Blog

for links, analysis, and commentary on the world of green banks and clean energy investment