The Clean Energy Future Blog

Introducing the American Green Bank Consortium

By Coalition for Green Capital

Today marks the launch of the American Green Bank Consortium, a new collaborative effort with partners across the U.S. designed to increase the impact and total clean energy investment made by Green Banks.

Green Banks will form the core membership of the Consortium, with a large cast of supporters also invited to join. Developers, investors, service providers, NGOs, foundations, policymakers and other actors eager to support and participate in Green Bank investment will all be engaged through the Consortium. The Consortium will also play an active role in any federal legislative efforts to combat the climate crisis.

Green Banks are dedicated clean energy finance organizations designed to catalyze greater public, private and mission-driven investment into clean energy markets. Green Banks in the U.S. have caused nearly $3 billion of total investment, expanding access to cost-saving clean energy solutions for businesses and households. The new Consortium is a first-of-its-kind membership organization, bringing together public, quasi-public, and non-profit Green Banks in the U.S. for the express goal of using their combined scale to raise more and new capital, develop and share common knowledge, and build a stronger Green Banking community. The Consortium will serve the needs of its members through representation, advocacy, fundraising, and networking. The collective goal of the Consortium is to add value for its members which will ultimately enable them to increase their investment in clean energy technologies in their local economies.

Founding members of the Consortium include the Baltimore Climate Access Fund, the Connecticut Green Bank, the Florida Solar Energy Loan Fund, the Hawaii GEMS financing program, Inclusive Prosperity Capital, the Maryland Clean Energy Center, Michigan Saves, the Montgomery County Green Bank, the Nevada Clean Energy Fund, the New York City Energy Efficiency Corporation, and the Rhode Island Infrastructure Bank.

The Consortium is being launched with the generous philanthropic support from a number of Foundations. The Energy Foundation, ClimateWorks Foundation, Bay & Paul Foundations, and Bellwether Foundations have all helped seed the new initiative.

The Consortium will lead a number of different activities and events, all focused on creating value for its members. Some of these activities include:

- Annual Green Bank Summit – A multi-day gathering that will address industry-wide topics of interest.

- Industry Working Groups – Consortium working groups will tackle big questions relevant to members, such as “The ITC Phase-out: Opportunities and Challenges for Green Banks”

- American Green Bank Consortium Advocacy – The Consortium will assist with Green Bank advocacy and education efforts on the federal, state, and local level.

- Access to Capital – Members will be afforded opportunities to access capital raised by the Coalition for Green Capital and its partners.

- Members-only Calls – A set of regularly scheduled, off-the-record talks with between members.

- Peer-to-peer Mentoring Network – A Member-to-Member support system for Green Banks.

- Deals for Members – Discounted packages of goods & services.

- Program Creation and Replication Assistance – Consortium will facilitate the transfer and creation of programs between Members across the country.

- Standardized Documents – A library of standardized documents for member use.

The Consortium is actively recruiting more members to join, either as Green Bank members or as supporters who are eager to join the community and scale up clean energy investment activity with Green Banks.

By Coalition for Green Capital

Green Banks, Green Funds and fellow green finance practitioners from around the globe gathered in Shanghai, China on November 29 for the sixth annual Green Bank Congress. Representatives from Clean Energy Finance Corporation (Australia), Green Investment Group, Connecticut Green Bank, Green Finance Organization Japan, Rhode Island Infrastructure Bank, Green Tech Malaysia and many more gathered for the annual event to discuss their latest deals, innovative financing techniques and various approaches to mobilizing private investment in green infrastructure.

Founding members of the Green Bank Network announced that they have collectively closed transactions of over US$11 billion that are expected to mobilize a total of US$41 billion in public and private capital for green infrastructure projects around the globe, effectively meeting their goal of US$40 billion by 2019 ahead of schedule.

The event included a number of emerging market representatives exploring Green Bank creation (through new or existing institutions) including speakers from China, South Africa, Indonesia, Chile, Mexico, India and Mongolia.

It was announced that a new Climate Finance Facility (CFF) has been formed in Southern Africa demonstrating a first-of-its kind, path-breaking application of the Green Bank model, adapted for emerging market conditions. The CFF received approval for capitalization from the Green Climate Fund in October 2018, and the Shanghai Congress was the first international forum to showcase the CFF since its successful approval.

Discussion themes at the Shanghai Green Bank Congress covered a wide range including Green Bank design, creation and successful on-going operation. A plenary session of major Development Finance Institutions (DFIs) discussed new ways to move “from lender to catalyzer” and mobilize private sector investment in green projects. One theme that emerged in the DFI discussion was partnering with local, country-level green intermediaries (such as Green Banks, Climate Finance Facilities, Strategic Green Investment Funds or similar) that carry mandates to crowd in private investment.

Rocky Mountain Institute, CGC, NRDC, Climate Policy Initiative and partners announced a new event for the coming year. In March 2019 a consortium of partners will organize the “Green Bank Design Summit” a hands-on, invitation-only workshop focused on designing, capitalizing and operating Green Banks in emerging markets. The event will be sponsored by AFD, ClimateWorks Foundation, the Green Climate Fund and others.

Additional panel sessions focused on Green Bank “tools of the trade” and successful techniques of existing Green Banks for mobilizing private co-investors, particularly in projects that may be first-of-a-kind, or under new regulatory structures. Speakers highlighted successful interventions in markets including energy efficiency, biogas, wind and solar, as well as emerging sectors such as electric mobility, adaptation, water, energy storage, or co-located clean energy projects with merchant or other kinds of offtaker risks.

The 2018 Green Bank Congress in Shanghai was an excellent opportunity for Green Banks and other green finance practitioners to gather and discuss new and existing models from mobilizing investment into green projects. Heading into the discussions of COP24, the investment gap to meet a 2 degree target is clearer than ever. While commitments made under the Paris Agreement are made by governments, there is widespread agreement that it will take a massive injection of private sector capital to deliver on those commitments. National Green Banks, empowered with patient capital and blended finance tools focused on mobilizing the private se ctor, will be a key part of achieving those goals.

Colorado Announces Green Bank

By Coalition for Green Capital

On Saturday, Governor John Hickenlooper announced the creation of a Colorado green bank. The green bank will be an independent, nonprofit entity called the “Colorado Clean Energy Fund” (CCEF). The objective of CCEF will be to drive private investment into clean energy projects and support the deployment of clean energy technologies in the state. To achieve this goal, CCEF will offer a variety of financial tools and services.

On Saturday, Governor John Hickenlooper announced the creation of a Colorado green bank. The green bank will be an independent, nonprofit entity called the “Colorado Clean Energy Fund” (CCEF). The objective of CCEF will be to drive private investment into clean energy projects and support the deployment of clean energy technologies in the state. To achieve this goal, CCEF will offer a variety of financial tools and services.

The creation of a Colorado green bank can build on the enormous growth of clean energy in Colorado. Colorado already has nearly 58,000 clean energy jobs across the state. With over 300 days of sunshine a year and one of the first renewable energy portfolio standards in the country, the Colorado clean energy market is developing at a breakneck pace. The price of renewables is becoming so cheap in Colorado, Xcel, one of Colorado’s major utilities, in on track to procure 55% of its portfolio from renewables by 2023. A green bank will be a powerful tool to build upon this growth and drive further investment in clean energy.

CGC’s Work

The Governor’s announcement is the culmination of a multi-year partnership between CGC and Colorado. Most recently, CGC has been working with the Colorado Energy Office (CEO) on a grant from the US Department of Energy to explore green bank creation options. During our work in Colorado, CGC has met with dozens of developers, nonprofits, advocates, and policy makers to discuss the green bank opportunity, and seen the enthusiasm for the concept first hand. Energy efficiency, distributed and community solar, and PACE are some of the focus areas for green bank activity that have surfaced through these conversations.

Now that CCEF has been created, next steps include finalizing the board and identifying potential projects for a first round of financing. CGC looks forward to our continuing engagement with Colorado and assisting in-state partners to launch the new institution.

CCEF Capitalizes on Benefits of Nonprofit Green Bank Structure

The Colorado Clean Energy Fund joins a growing number of nonprofit green banks, including the recently formed Nevada Clean Energy Fund. The growth of the nonprofit model is enabled by the emergence of alternative sources of capital and practitioner networks for green banks. As philanthropies and foundations increasingly express interest in supporting clean energy finance through grants and program related investments, nonprofit green banks are ideally positioned to deploy capital on their behalf.

As CCEF works to tap into these new networks, it will have access to the newly formed American Green Bank Consortium. The Consortium is a CGC initiative which will act as a hub to facilitate shared expertise, best practices, and capitalization strategies among green banks and green bank supporters. The consortium will also offer ad hoc consulting services and technical assistance to existing green banks and parties interested in creating green banks. CCEF will be able to tap into this robust network to learn directly from successful green banks across the country while meeting potential partners for future projects and capital raising.

By Coalition for Green Capital

Last week, the Green Bank world hit an exciting and crucial milestone. The Green Climate Fund (GCF) became the first multilateral institution in the world to capitalize and fund a local Green Bank in a developing nation. The GCF approved a $55 million loan to the Development Bank of Southern Africa’s (DBSA) new Climate Finance Facility (CFF), and also provided $600,000 for an operating grant. Once launched, the CFF will likely be the first operational Green Bank in the developing world, utilizing the models implemented by Green Banks in places like the U.K, Australia and the United States.

This is noteworthy for several reasons. The first is the obvious one – as made plainly clear by the Intergovernmental Panel on Climate Change, we are losing the climate battle and have little time left to save the planet. Driving as much capital as possible into all corners of the globe is vital, especially carbon-laden places like Southern Africa. Using capital sources like the GCF to support Green Banks, which themselves aim to catalyze further investment, shows a new way to aim for scale.

Second, it is an important precedent because it shows other development-focused institutions, like multilateral development banks (MDBs), ways to deploy their capital. Locally-led initiatives like Green Banks are aimed at crowding-in more private investment. MDBs need to wring every dollar of leverage they can out of their investments in climate, and place-based Green Banks are a perfect vehicle for that objective.

And perhaps most importantly, the GCF funding loudly announces to the world that the Green Bank model is evolving. No longer is the Green Bank story one where the only pools of capital are “public and private.” Green Banks historically have been solely capitalized by the governments that created them, which then use those public dollars to support private investment. This bimodal structure needs a refresh.

Public funds, in both developed and developing world, are far too scarce and new sources of capital are now available that Green Banks can deploy. Blending different sources of capital to raise large pools of funds is what is needed for Green Banks to be scalable and innovative drivers of climate investment. The work of securing public capital at scale in countries like the U.S. can be arduously slow. And public capital can be even scarcer in developing countries, so new sources – like the GCF – are a valuable addition to the traditional model.

CGC pivoted to executing this new approach in 2017. And Green Bank partners are leading the way, too. The Climate Access Fund (CAF), a non-governmental non-profit Green Bank in Maryland, quickly secured $2 million from local foundation and impact investments to pilot a low-income focused community solar project. CGC helped incubate CAF, structuring products and raising the seed capital. And by identifying market gaps and structuring innovative financial solutions, CAF attracted the interest of the state government, which then provided $1 million in matching guarantees.

NY Green Bank is raising $1 billion of private capital to expand its footprint outside New York State. The Connecticut Green Bank created a non-profit spin-off, Inclusive Prosperity Capital, to work in other states, and is securing a foundation guarantee which it can use as credit protection to raise funds from a range of capital providers. Both saw an opportunity to use the infrastructure they already built to bring in new, diverse sources of funding, rather than waiting and relying purely on their own governments to fund them. The New York City Energy Efficiency Corporation (NYCEEC) has used diverse sources of capital since its founding, leading the way on many innovative program related investment (PRI) structures.

Green Banks continue to create and deploy innovative methods for financing clean energy and driving more total investment into the market. But the vital evolution, that we are now seeing play out, is a move to take advantage of the full suite of capital sources available. Green Banks can and should have balance sheets with public, private, mission, impact, development and foundation dollars.

This is CGC’s new approach – working with Green Banks of all forms to raise money from all of these sources. The GCF and DBSA should be congratulated for supporting the new generation of Green Banks. ClimateWorks Foundation and Convergence Blended Finance deserve credit for being the first foundations to see this opportunity and funding CGC and the CFF formation. Now it is time for established and new Green Banks around the world to continue raising large diverse pools of capital to drive maximum investment to all corners of the globe.

By Coalition for Green Capital

The CFF is modeled on Green Banks created in other countries, but marks the first Green Bank in Africa. When launched, the CFF is likely to be the first application of the Green Bank concept in a developing nation. This also marks the first time the GCF has funded a Green Bank anywhere in the world.

When operational, the CFF will use its own capital to catalyze multiples of private investment into a range of climate-related markets.

With support from Convergence Finance and ClimateWorks, CGC worked with the DBSA and South Africa-based partners Green Cape to help design the CFF, secure capitalization, and craft the GCF funding application.

CGC CEO Reed Hundt said, “We at CGC wish DBSA the best of luck in this new enterprise. The world is eager to see the CFF catalyze private clean energy investment in Southern Africa, as green banks have done in other markets. The battle against climate change very much needs reinforcements. CGC is also enormously grateful to Convergence Finance and the Climate Works Foundation for their generous support of this project.”

Andrea Colnes, director of CGC’s international program said, “We are thrilled to see this successful partnership with DBSA generate this vital and precedent-setting funding from the GCF. We think there’s a clear path for other countries to secure funding and form Green Banks, and interest has already begun to emerge in several developing nations.”

The GCF’s decision is important because it is one of only a handful of projects where GCF funds will flow directly to a local public finance institution. The DBSA, a “direct access” accredited entity under the GCF, will use these funds to launch the CFF as a dedicated Green Bank program within the local financial ecosystem and tied to local priorities. The GCF is providing concessional debt capital to the CFF, which will enable the CFF to catalyze additional private investment from local commercial banks and asset managers.

Following the Green Bank model, the CFF will focus its investments to “crowd in” private investment at the project level in green sectors where projects currently struggle to access affordable financing at commercial terms. In this way, the CFF will offer globally significant proof-of-concept value to middle- and lower-income nations seeking to create local institutions that address market barriers and scale up the high levels of private investment required by Paris climate commitments.

The DBSA has been in close discussions with the Green Bank Network (GBN) – an organization formed to foster collaboration and knowledge exchange among Green Banks – about GBN membership, and the CFF hopes to soon to join the GBN. DBSA has been invited to speak at the GBN’s flagship event, the Green Bank Congress, on November 29, 2018. CGC serves as the co-secretariat for the GBN.

ABOUT CGC

The Coalition for Green Capital (CGC) is a leading expert, advisor and implementer of Green Banks, dedicated clean energy finance institutions that blend multiple sources of capital to catalyze grater investment in GHG reducing technology. CGC has created multiple Green Bank and related entities, which have driven over $2 billion of investment. CGC has led Green Bank formation and investment efforts in the US for a decade, and is eager to expand its international activities based on its work in South Africa.

By Coalition for Green Capital

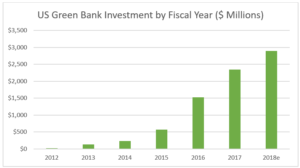

Green Banks in the US have been powerful tools for driving capital into clean energy markets.

CGC reviewed annual reports and transactions at nine US-based Green Banks from their inception through fiscal year 2017. At the end of 2017, these institutions participated in transactions representing more than $2.3 billion of cumulative clean energy investment. Nearly $1.7 billion of the overall investment came from private sources, demonstrating the continuing ability of Green Banks to leverage private dollars into clean energy markets.

CGC reviewed annual reports and transactions at nine US-based Green Banks from their inception through fiscal year 2017. At the end of 2017, these institutions participated in transactions representing more than $2.3 billion of cumulative clean energy investment. Nearly $1.7 billion of the overall investment came from private sources, demonstrating the continuing ability of Green Banks to leverage private dollars into clean energy markets.

Over the past six years, public to private leverage ratios have increased as Green Banks become more effective at crowding in private investment. In the past year, leverage ratios hit all-time highs. For example, the Connecticut Green Bank achieved a public to private investment leverage ratio of 8:1 for FY 2017, double the 4:1 ratio achieved in FY 2014. This new high raises Connecticut Green Bank’s overall leverage ratio to 6:1. Future leverage ratios are expected to increase as Green Banks develop streamlined methods for attracting private capital. For example, the New York Green Bank, which currently has an overall leverage ratio of 3:1, expects to increase its overall leverage portfolio to 8:1 by 2025.

Notable projects in FY 2017/2018 included New York Green Bank’s $54.3 million loan to Motivate International, parent of the Citibike bike share network. This marks one of the first major transactions in clean transportation sponsored by a Green Bank, paving the road for greater activity in the sector. To date, the majority of observed Green Bank projects were solar and energy efficiency projects.

Ambitious projections from the New York Green Bank, Rhode Island Infrastructure Bank, and Michigan Saves have set Green Bank transaction totals on track to exceed $2.9 Billion by the end of fiscal year 2018. New Green Banks, including those CGC helped develop in Nevada and Colorado, will soon begin financing clean energy projects in their states as well. Operating under an independent, nonprofit model, these organizations represent a new wave of Green Banks that can drive investment into clean energy projects across the U.S. This activity cements a trend of increasing investment as new and existing Green Banks ramp up operations across the US.

As Green Bank operations grow in scale, new pools of capital are becoming available for Green Bank use. These include the $1 billion fund announced by the New York Green Bank for domestic investment, funds under development at NYCEEC and Inclusive Prosperity Capital (formerly part of the Connecticut Green Bank), and program related investment (PRI) from a variety of foundations expressing greater interest in the Green Bank movement.

To further catalyze Green Bank investment and capitalize on the observed trends, CGC is developing a new initiative called the American Green Bank Consortium. The Consortium, designed as a domestic trade association for Green Banks, will serve as the currently missing connective tissue in the Green Bank ecosystem to drive investment volume and efficiently share innovative clean energy financing practices among members. Members will include new and existing Green Banks as well as developers and capital providers that frequently partner with Green Banks. The Consortium is scheduled to launch in Q1 2019 and will work to catalyze even greater Green Bank investment over the coming years.

The nine Green Banks reviewed were: the California Lending for Energy and Environmental Needs (CLEEN) Center, the Connecticut Green Bank, the Hawaii Green Energy Market Securitization (GEMS) Program, the Montgomery County Green Bank, Michigan Saves, the New York City Energy Efficiency Corporation (NYCEEC), the New York Green Bank, the Rhode Island Infrastructure Bank, and the Solar and Energy Loan Fund (SELF).

Follow

The Clean Energy Future Blog

for links, analysis, and commentary on the world of green banks and clean energy investment