A new expert report from Vivid Economics, a leading strategic economics consulting firm with expertise in energy and public investment, finds that the Clean Energy Jobs Fund will create 5.4 million job-years in five years by investing in clean energy projects across the U.S. (Economists use the term job-year to measure the amount of work of a period of time. One job for one year is one job-year.)

The Clean Energy Jobs Fund (CEJF) is a nonpartisan nonprofit that, with a $35 billion deposit from Congress, would drive nearly $500 billion of total investment across a range of sectors, the report found. The analysis also found that over a 20-year period the fund would drive nearly $2 trillion of investment.

The CEJF uses the green bank model and is described in the National Climate Bank Act of 2019, which was introduced by Sens. Van Hollen and Markey, and Rep. Debbie Dingell. Nearly 100 organizations are now pushing for inclusion of the und and $35 billion to get it started as part of the House’s planned infrastructure and clean energy package.

The Vivid analysis considered a range of factors in its analysis, primarily focusing on the track record of existing national, state and local green banks, and what investments can be practically deployed in the near future. “The investment portfolio for the CEJF considered in this analysis sets out an allocation of investment capital to support an executable investment plan for the CEJF,” the report stated.

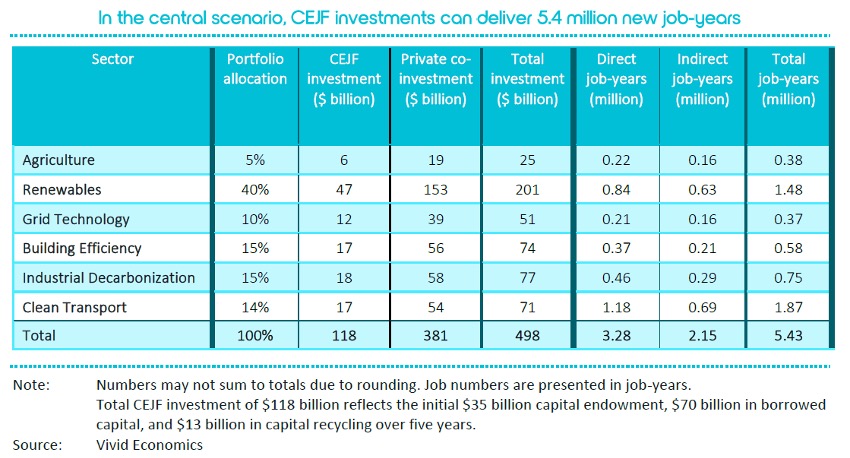

The analysis assumes that the $35B capitalization will be leveraged with borrowing at a conservative 2-to-1 ratio. This would provide the CEJF $105B in investment capacity. Investments would then be allocated across projects in the renewable, building efficiency, industrial decarbonization, clean transportation, grid infrastructure and sustainable agriculture sectors. CEJF investment would leverage private co-investment, and it would also be repaid to allow for recycling and further investing. (Climate resilience is also an eligible sector for investment and will be included in follow-on analyses from Vivid.)

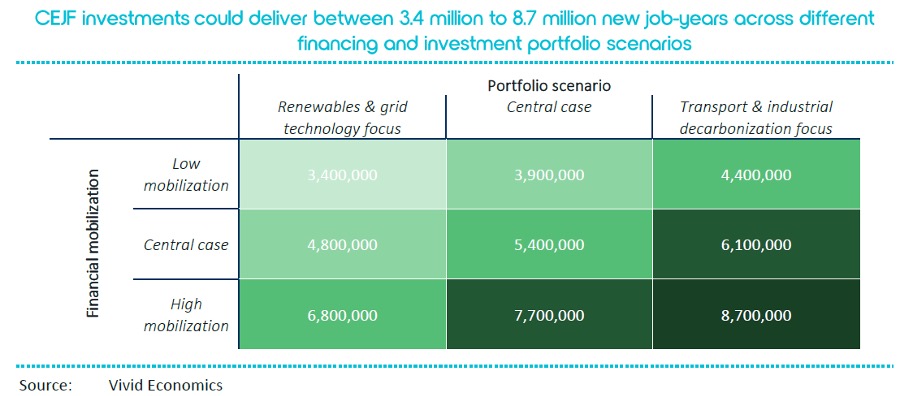

Depending on the portfolio allocation and assumed private sector leverage, the analysis found the range level of job creation could range from 3.4M up to 8.7M job-years over the five year-period:

In the central case of the analysis (the middle scenario), the net result over a five-year period would be $118B of total CEJF investment combined with $381B of private co-investment for a total of $498B of investment. This in turn would create 3.28M direct jobs and 2.15M indirect jobs, for a total of 5.43M jobs created. (Induced jobs were not considered as part of the analysis).

And new jobs are needed more than ever.

At the end of May, 21.5M Americans filed continued claims for unemployment insurance, which means the CEJF would put 1 in 4 of those Americans back to work.

The CEJF will be authorized to directly finance projects of national or regional scale. However, it is expected the majority of financing activity will happen with and through state and local green banks. The CEJF is meant to both build new green banks where they don’t exist, and then to fund those new and existing green banks to support clean energy, resilience and climate-related projects in communities across the country.

The experience of state and local green banks already operating in the U.S. today has shown that most activity, investment decisions, contractors and community engagement are best served by a more local-entity. Existing green banks in the U.S. have now mobilized over $5B of total investment, leveraging $2.60 of private investment for each green bank dollar deployed. The greatest barrier to the growth of state and local green banks is the necessary public seed capital. The CEJF is meant to remove that barrier to let local investment flourish across the U.S.

Polling conducted last month by CGC found that 4 out of 5 voters nationally want Congress to invest in clean energy job creation. The same poll found that voters in competitive U.S. House districts and Senate races—the voters that will determine which party controls Congress—also strongly support a Clean Energy Jobs Fund.

Rarely do the numbers add up in politics. But for the Green Energy Jobs Fund, they do. Voters say so, and now so does Vivid Economics.