The Clean Energy Future Blog

Statement Supporting Black Lives Matters

By Coalition for Green Capital

The Coalition for Green Capital released the following statement in light of the police murder of George Floyd and calls for the United States to root out systemic racism.

Over the past weeks we have once again seen the dehumanization and devaluation of Black lives in America. The systemic violence and inequality in this country are intolerable, and this must stop. The entire CGC organization stands with the Black community and protesters. We will work with them to end this injustice.

CGC was founded to build a better future. That is why, particularly at this moment, CGC is committed to listening, learning and working to become a more equitable and inclusive organization. These values are central to what we advocate for and how we must reverse the impacts of climate change. In this way, we hope to do our part to bring justice to our world.

By Coalition for Green Capital

The U.S. Energy Information Administration (EIA) report released yesterday forecasts energy prices are not expected to recover soon with WTI oil prices staying below $50/barrel until end of 2021. Energy players are looking at all options to forge ahead. Oil giant BP announced earlier this week that it will cut 10,000 jobs to reduce costs. Not surprisingly, all energy companies have been looking to cut spending as oil prices have swooned in recent years beginning with a slide in 2015 from over $100/barrel to below $50/barrel. In the last 5 years, oil prices have remained volatile, gyrating from below $30/barrel in 2016 to almost $80/barrel in 2018 and then crashing to near zero earlier this year, before rebounding to $38/barrel yesterday.

This volatility has shaken up the industry and many energy companies are taking the predictable path of reducing expenses and deferring capital expenditures. Meanwhile others are looking at unexpected saviors, from private equity and competitors, financial investors and lenders, to utilities and corporate consumers, from hedging with Wall Street banks to public funds from Congress.

By Jeffrey Schub

A new expert report from Vivid Economics, a leading strategic economics consulting firm with expertise in energy and public investment, finds that the Clean Energy Jobs Fund will create 5.4 million job-years in five years by investing in clean energy projects across the U.S. (Economists use the term job-year to measure the amount of work of a period of time. One job for one year is one job-year.)

The Clean Energy Jobs Fund (CEJF) is a nonpartisan nonprofit that, with a $35 billion deposit from Congress, would drive nearly $500 billion of total investment across a range of sectors, the report found. The analysis also found that over a 20-year period the fund would drive nearly $2 trillion of investment.

The CEJF uses the green bank model and is described in the National Climate Bank Act of 2019, which was introduced by Sens. Van Hollen and Markey, and Rep. Debbie Dingell. Nearly 100 organizations are now pushing for inclusion of the und and $35 billion to get it started as part of the House’s planned infrastructure and clean energy package.

The Vivid analysis considered a range of factors in its analysis, primarily focusing on the track record of existing national, state and local green banks, and what investments can be practically deployed in the near future. “The investment portfolio for the CEJF considered in this analysis sets out an allocation of investment capital to support an executable investment plan for the CEJF,” the report stated.

The analysis assumes that the $35B capitalization will be leveraged with borrowing at a conservative 2-to-1 ratio. This would provide the CEJF $105B in investment capacity. Investments would then be allocated across projects in the renewable, building efficiency, industrial decarbonization, clean transportation, grid infrastructure and sustainable agriculture sectors. CEJF investment would leverage private co-investment, and it would also be repaid to allow for recycling and further investing. (Climate resilience is also an eligible sector for investment and will be included in follow-on analyses from Vivid.)

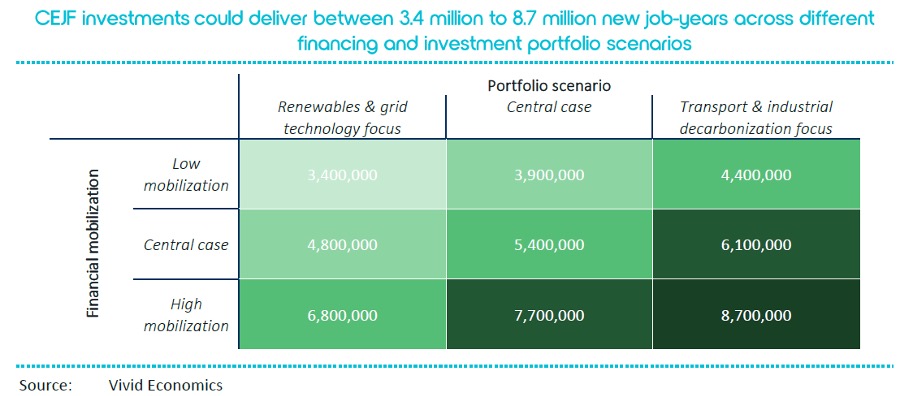

Depending on the portfolio allocation and assumed private sector leverage, the analysis found the range level of job creation could range from 3.4M up to 8.7M job-years over the five year-period:

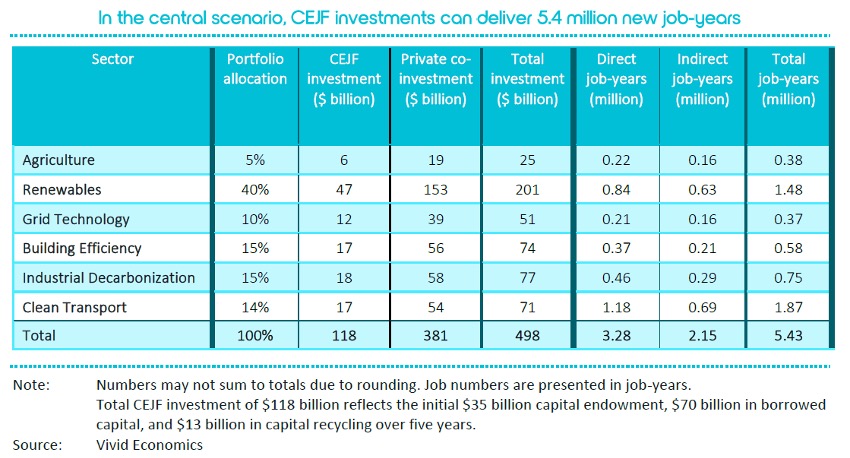

In the central case of the analysis (the middle scenario), the net result over a five-year period would be $118B of total CEJF investment combined with $381B of private co-investment for a total of $498B of investment. This in turn would create 3.28M direct jobs and 2.15M indirect jobs, for a total of 5.43M jobs created. (Induced jobs were not considered as part of the analysis).

And new jobs are needed more than ever.

At the end of May, 21.5M Americans filed continued claims for unemployment insurance, which means the CEJF would put 1 in 4 of those Americans back to work.

The CEJF will be authorized to directly finance projects of national or regional scale. However, it is expected the majority of financing activity will happen with and through state and local green banks. The CEJF is meant to both build new green banks where they don’t exist, and then to fund those new and existing green banks to support clean energy, resilience and climate-related projects in communities across the country.

The experience of state and local green banks already operating in the U.S. today has shown that most activity, investment decisions, contractors and community engagement are best served by a more local-entity. Existing green banks in the U.S. have now mobilized over $5B of total investment, leveraging $2.60 of private investment for each green bank dollar deployed. The greatest barrier to the growth of state and local green banks is the necessary public seed capital. The CEJF is meant to remove that barrier to let local investment flourish across the U.S.

Polling conducted last month by CGC found that 4 out of 5 voters nationally want Congress to invest in clean energy job creation. The same poll found that voters in competitive U.S. House districts and Senate races—the voters that will determine which party controls Congress—also strongly support a Clean Energy Jobs Fund.

Rarely do the numbers add up in politics. But for the Green Energy Jobs Fund, they do. Voters say so, and now so does Vivid Economics.

Nearly 100 Groups Mobilize to Push Congress for Clean Energy Jobs Fund in Infrastructure Bill

By Coalition for Green Capital

FOR IMMEDIATE RELEASE

June 5, 2020

press@

Nearly 100 Groups Mobilize to Push Congress for Clean Energy Jobs Fund in Infrastructure Bill

Sierra Club, Environmental Defense Fund, NRDC, League of Conservation Voters, Solar Energy Industries Association join effort

Geographically broad groups span industry, environment, labor

WASHINGTON—Nearly 100 organizations today sent a letter to U.S. House and Senate leaders requesting future economic recovery legislation include $35 billion for a nonprofit Clean Energy Jobs Fund to put 5 million Americans back to work.

With more than 40 million American jobs lost due to the COVID-19 pandemic so far and studies showing that up to 42 percent of those jobs will not return, the groups argue that Congress must urgently make long term investments that create jobs and build a cleaner future.

“The United States will be battling the health crisis for the foreseeable future and immediate relief is critical. But it is not enough,” the groups wrote. “Congress should respond by depositing $35 billion into the nonprofit, nonpartisan Clean Energy Jobs Fund to create 5 million new jobs.”

The letter, spearheaded by the Coalition for Green Capital, was signed by a diverse group of industry, trade and environmental advocacy groups, along with state and local officials. Large environmental organizations include the Sierra Club, Environmental Defense Fund, National Resources Defense Council, League of Conservation Voters, Union of Concerned Scientists, Climate Reality Project and Appalachian Voices.

Other key clean energy industry groups— Solar Energy Industries Association, Energy Storage Association, Vote Solar, and Advanced Energy Management Alliance—added their voices backing the proposed Clean Energy Jobs Fund.

State green banks and funding agencies, innovative start-ups and larger corporations, clean tech investors, utilities and regional advocacy groups—from Alaska to Hawaii, Florida to Michigan, Colorado to Pennsylvania and dozens more states—all signed on to support the clean energy jobs fund. Their support signals that this proposal is an effective way to put people to work and reduce greenhouse gas emissions.

The fund, as envisioned in H.R. 5416 and S. 2057, would use the green bank model to pair each public dollar with multiple private ones to build a range of clean energy projects throughout the U.S. This includes renewable power, building efficiency, grid infrastructure like transmission, industrial decarbonization, clean transportation, reforestation and climate-resilient infrastructure. Because the dollars are repaid over time, they can be recycled to make additional investments in the future.

Twenty percent of the funds must go to low-income and climate-impacted communities, many of which have also been hard hit by the COVID-19 pandemic.

The groups added: “Each project financed by the Fund will require Americans with all kinds of skills and backgrounds. Today, half the jobs in the clean energy sector are in sales, administration and management. These are roles that can be filled quickly by those laid off from other sectors with matching skill sets.”

Recent national polling shows eight out of 10 Americans want Congress to create clean energy jobs and seven out of 10 support depositing $35 billion into a fund to achieve this. The groups concluded: “Voters across parties want Congress to invest in clean energy job creation to put Americans back to work.”

Read the letter and full listing of groups that signed it below.

We write at this urgent time with recommendations to support your efforts to respond to the unfolding economic crisis. The United States will be battling the health crisis for the foreseeable future and immediate relief is critical. But it is not enough. Today, 4 out of 5 voters nationally want Congress to create new jobs to build clean energy infrastructure. Congress should respond by depositing $35 billion into the nonprofit, nonpartisan Clean Energy Jobs Fund to create 5 million new jobs.

Over forty million people so far are out of work because of the coronavirus and ensuing economic shutdown. The shutdown, new consumer habits and changed behavior due to Covid-19 have led to structural changes in the U.S. economy and its workforce. Millions of Americans in the retail, dining, entertainment, travel sectors, among others, will not be able to quickly return to their old jobs. That means it is essential for Congress to help create new jobs for Americans.

In national polls 4 out of 5 voters want Congress to invest in new jobs to build clean energy infrastructure, like wind turbines, solar panels, power lines, and EV charging. And 69% say the U.S. government should deposit $35B in the nonpartisan, nonprofit Clean Energy Jobs Fund to achieve that objective.

The opportunity to build the infrastructure to generate, move, store and use clean and efficient energy is nearly boundless. Trillions of dollars of investment is needed to build clean energy infrastructure that will put millions back to work, strengthen communities, reduce pollution, improve public health, lower energy costs, and reduce greenhouse gas emissions.

The Clean Energy Jobs Fund (as envisioned by Sens. Markey and Van Hollen (S.2057) and Rep. Debbie Dingell (H.R.5416) in the National Climate Bank Act of 2019) is an excellent vehicle for this investment because it will pair each public dollar with multiple private ones to build a range of clean energy projects. This includes renewable power, building efficiency, grid infrastructure like transmission, industrial decarbonization, clean transportation, reforestation and climate-resilient infrastructure. Each public dollar invested will be repaid and preserved by the Fund, which means dollars can be recycled to cause even more private investment in the future.

The Fund will use the green bank model that has been proven at the state and local level in the U.S. There are already successful green banks in states like Michigan, Florida, Connecticut and Hawaii, and new ones in place in Colorado, Ohio, and Nevada. These green banks have driven over $5 billion of investment into clean energy, and for each public dollar invested, 2.6 dollars of private investment has followed.

Each project financed by the Fund will require Americans with all kinds of skills and backgrounds. Today, half the jobs in the clean energy sector are in sales, administration and management. These are roles that can be filled quickly by those laid off from other sectors with matching skillsets.

To strengthen communities in every corner of America, the Fund will help form new regional, state or local green banks across the U.S. and then provide the funding necessary for them to invest. This will build a network of local institutions designed expressly to meet the employment, energy, development and environmental needs of that community. The Fund will also help fund the expansion of those green banks that already exist and are showing others how to lead the way.

No community will be overlooked. 20% of the Fund’s investment must go to frontline, low-income and climate-impacted communities. Existing green banks have already proven the possible, delivering clean energy and health benefits to communities that have historically been left behind. This ensures good clean energy jobs are formed throughout the U.S.

The Fund is the evolution of the Clean Energy Deployment Administration (CEDA), introduced in Congress in 2009. CEDA enjoyed broad bipartisan support, passing the House Energy & Commerce Committee with a 51-6 vote and then the entire House. And it passed the Senate Energy & Natural Resources Committee with a 15-8 bipartisan vote.

This kind of broad support still exists. Immediate relief is essential in this crisis, but so too is providing a livelihood for the millions of American families and households out of work. Voters across parties want Congress to invest in clean energy job creation to put Americans back to work. And to do this, voters want Congress to fund the Clean Energy Jobs Fund.

Sincerely,

Environmental Non-Profit Organizations

Appalachian Voices

Chesapeake Climate Action Network

The Climate Reality Project

Energy Efficiency Alliance of New Jersey

Environmental Defense Fund

Fresh Energy

League of Conservation Voters

Maryland League of Conservation Voters

Natural Resources Defense Council

New Jersey League of Conservation Voters

Sierra Club

Union of Concerned Scientists

Vote Solar

Trade and Industry Associations

Advanced Energy Management Alliance

American Green Bank Consortium

Americans for a Clean Energy Grid

Coalition for Community Solar Access

Coalition for Green Capital

Energy Storage Association

Fuel Cell and Hydrogen Energy Association

Keystone Energy Efficiency Alliance

Maryland Building Performance Association

Michigan Energy Efficiency Contractors Association

North Carolina Sustainable Energy Association

Northeast Clean Energy Council

Renewable Energy Alaska

Silicon Valley Leadership Group

Solar Energy Industries Association

Southern Renewable Energy Association

Financial Institutions and Funds

Atmos Bank

Climate Action Fund

Colorado Clean Energy Fund

Community Office for Resource Efficiency (CORE)

Connecticut Green Bank

DC Green Bank

Delaware Sustainable Energy Authority

Energy Resource Center, Colorado

Energy Outreach Colorado

Florida Solar Energy Loan Fund

Generate Capital

Greenworks Lending

Hawai’i Green Infrastructure Authority

Inclusive Property Capital

Maryland Clean Energy Center

Michigan Saves

Montgomery County Green Bank

Neighborhood Sun Benefit Corporation

New York City Energy Efficiency Corporation

Park City Community Foundation

Rhode Island Infrastructure Bank

Spark Northwest

Clean Energy Companies and Utilities

Ameresco

Amperon

Aris Energy Solutions, LLC

Atlas Home Energy Solutions

Bicky Corman Law PLLC

BlocPower

Build Efficiently, LLC

CertainSolar

Dollaride

eCAMION, USA

Elevation Lighting Services Company

Energy Efficiency Experts LLC

EnergyHub

The Engine

First Cast Communications

Form Energy

Green Generation

Greentown Labs

GRID Alternatives

Ground Loop Heating and Air Conditioning, Inc.

Hawaiian Electric

Hunt Consulting

Integro, LLC

Maalka

Main Street Launch

Mortenson

Mountain View Solar and Wind

PosiGen, Inc.

Powerhouse

Raise Green

Recurrent Innovative Solutions, LLC

RER Energy Group

Rivermoor Energy

Solar United Neighbors

Solstice

Sustainable Real Estate Solutions, Inc.

WexEnergy

Zinc8 Energy Solutions

State and Local Governments

California State Treasurer Fiona Ma, CPA

Hawai’I State Energy Office

cc:

The Honorable John Barrasso

The Honorable Tom Carper

The Honorable Chris Van Hollen

The Honorable Ed Markey

The Honorable James Clyburn

The Honorable Steny Hoyer

The Honorable Peter DeFazio

The Honorable Sam Graves

The Honorable Frank Pallone

The Honorable Debbie Dingell

###

By Coalition for Green Capital

By SAMANTHA MALDONADO

06/02/2020

States are tapping public financing institutions to advance a green agenda and create jobs as they plan their economic rebound from the coronavirus pandemic.

New Jersey adopted the idea in April, saying it will set up a green bank by the end of the year to finance environmentally friendly infrastructure. The state follows in the footsteps of Connecticut, New York and other states that provide loans and grants to fund carbon-cutting projects, such as community solar and energy efficiency retrofits.

By Jillian Bunting

On Friday, CGC submitted a response to the New Jersey Economic Development Authority’s Request for Information on a “Potential Green Financing Mechanism to be Established by the State of New Jersey.” The full response can be viewed here.

New Jersey has been making steady progress towards the creation of a transformative Green Financing Mechanism (aka a Green Bank). Most recently, the state announced a $12 million annual commitment to fund the institution through allocations from RGGI. CGC has been engaged in New Jersey for several years, beginning with starting with a 2018 analysis of the clean energy finance opportunity in New Jersey produced by the Environmental Defense Fund and CGC.

CGC’s response highlights the ability of a Green Bank to make progress on critical priorities. The largest sources of emissions in New Jersey are transportation, power and buildings. While lowering emissions in these sectors is essential, maintaining or lowering the cost of energy to New Jersey households and businesses is equally critical. This is truer now more than ever, as households struggle to make ends meet. The essential role of the Green Bank is to provide its financing in a way that can still attract private capital that earns its necessary return while also delivering affordable clean energy.

Furthermore, over a million workers in New Jersey are out of work, many from industries that will not soon bounce back and create jobs to rehire. That means the state must look to reshape its labor force and give its citizens new, better jobs of the future with good pay in safe condition. Construction of the state’s clean power platform requires people of all skills. Sales, customer service, marketing, engineering, contracting and other skills are needed. The Green Bank can be the vehicle to put New Jersey back to work again.

With funding commitments in place, the RFI is the next step in further clarifying the process for bringing a Green Bank to life in New Jersey. Based on prior engagement with stakeholders in the state, CGC’s response recommends forming the Green Bank as a program that is housed, launched and incubated within the EDA, and which is ultimately able to stand on its own as an independent non-profit corporation. This would let the Green Bank enjoy the best of both worlds: the benefits of strong backing by the state at its inception, while ensuring it can operate independently and with strength long into the future as administrations come and go.

Follow

The Clean Energy Future Blog

for links, analysis, and commentary on the world of green banks and clean energy investment