The Clean Energy Future Blog

What If We Never Run Out of Oil?

By Coalition for Green Capital

A recent article published in the Atlantic by Charles Mann, makes the reader think about the seemingly-ludicrous question: What if we never run out of oil?

The question is prompted by a discussion of methane hydrate—a crystalline natural gas found under areas of permafrost and in the ocean floor. This resource is estimated to be twice as abundant as all other fossil fuels combined and has a total volume equal to that of the Mediterranean Sea. The fuel burns like natural gas; however, it burns clean. Discoveries like this seem to support the view of many social scientists that natural resources are not a finite physical entity. Rather, one can think of natural resources as an economic judgment. If demand for one resources plummets and the market stalls, then it’s time to innovate and develop a new market.

Complications abound in a world governed by purely economic judgments, yet don’t they also in a world facing finite resources?

Charles Mann, The Atlantic, April 24, 2013, Available here.

By Coalition for Green Capital

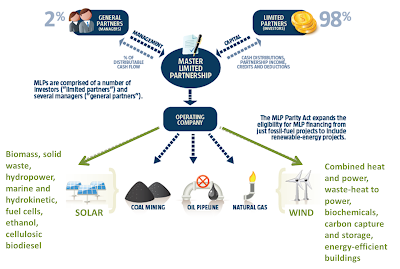

Senator Coons (D-Delaware) has just announced that he will be introducing the Master Limited Partnership Parity Act. This Bill would level the playing field for renewable energy investors by enabling them to adopt a corporate structure that currently gives tax advantages to fossil-fuel investors.

A master limited partnership (MLP) is a business structure that is taxed as a partnership but whose ownership interests are traded like corporate stock on a market. Publicly traded C-corporations are taxed at the corporate and the shareholder level. An MLP, however, avoids this double taxation since the corporation is treated as a partnership and only the shareholders are taxed. The MLP  consists of limited partners (investors) and general partners (managers). The numerous limited partners receive quarterly distributions (equivalent to dividends paid to C-corp shareholders) in return for providing capital. Whereas the limited partners play no role in the management of the MLP, the general managers (usually in the form of another company or a group of individuals) have full control of daily operations and typically hold 2% ownership stake. Historically, many MLPs have offered investors stable returns around 6-7%.

consists of limited partners (investors) and general partners (managers). The numerous limited partners receive quarterly distributions (equivalent to dividends paid to C-corp shareholders) in return for providing capital. Whereas the limited partners play no role in the management of the MLP, the general managers (usually in the form of another company or a group of individuals) have full control of daily operations and typically hold 2% ownership stake. Historically, many MLPs have offered investors stable returns around 6-7%.

Given the attractiveness of the MLP structure, why hasn’t it been able to aid the renewable industry in the past? The catch is that MLPs must get at least 90% of their income from “qualified sources.” Historically, qualified sources have included real estate or natural resources such as crude oil, petroleum products, coal, timber, and other minerals. According to Section 613 if the federal tax code, qualified energy sources must come from depletable sources. $320 billion of the $445 billion in the aggregate MLP capital market have gone into midstream oil and gas pipeline projects.

The MLP Bill will expand the definition of “qualified resources” to include clean energy sources and infrastructure projects including wind, closed and open loop biomass, solar, municipal solid waste, hydropower, marine and hydrokinetic fuel cells, and other clean fuel sources. By extending the MLP benefits to clean energy and infrastructure projects, the Bill will:

- Attract more investors to the clean energy market with relatively low but stable dividends, while reducing project financing costs by up to fivefold

- Increase the federal tax base because new markets will be opened to investors will have to pay taxes

- Bring more total renewable energy and infrastructure projects online

- Enable more Americans to benefit from investments in clean energy because the current tax breaks (Investor Tax Credit and accelerated depreciation) only benefit wealthy entities such as large banks and corporations with huge tax burdens

CGC has a multifaceted mission statement and collaborates on a wide variety of initiatives. However, one raison d’être not to be overlooked is our mission to advocate for tax and finance policies that support investment in energy efficiency and clean energy. CGC is a proud supporter of Senator Coons’ Master Limited Partnership Parity Act and hopes you will be too.

If you or your organization would like to support the Bill please contact CGC for more information by emailing coalitionforgreencapital@gmail.com

Sources/ For more information:Anthony Reale , Master Limited Partnerships, JP Morgan, Felix Mormann and Dan Reicher, How to Make Renewable Energy Competitive, The New York Times, June 1, 2012.Master Limited Partnerships Parity Act, Senator Coons, April 24, 2013

Limits to Innovation

By Coalition for Green Capital

Here at CGC we are all about innovation and ingenuity. However, it’s important to step back and recognize what limits there are to ingenuity. As James Boyce of Resources for the Future says, “There aren’t many substitutes for the relatively untouched expanse of Alaska’s North Slope if what matters to you is its very wilderness.”

In the famous 1970s Ehrlich-Simon wager, economist Julian Simon bet biologist Paul Ehrlich $1,000 that the combined price of five commodity metals would fall over the next decade. Ehrlich lost the bet. Because commodity metals can be traded and sold on a private market, businesses and consumers eagerly sought substitutes for the hard-to extract and finite resources at the center of the Ehrlich-Simon wager and prices fell.

But what about resources that “you don’t eat or mine and you can’t find on any international exchange or market?” What about resources as abstract and sublime as wilderness? How do we find an innovative substitute for that?

Distributed Solar – Part III

By Coalition for Green Capital

To follow up on the April 8 blog post about distributed solar, we thought it would only be fair to share both sides of the distributed solar roll-out plan. Below is a table comparing reasons for accelerating the distributed solar push and reasons for letting it grow more languidly.

Accelerated Distributed Solar Roll-Out |

Slow Distributed Solar Roll-out |

|

|

|

|

|

|

|

|

|

|

|

|

Distributed Solar – Part II

By Coalition for Green Capital

An additional benefit of “green collar jobs” that could be created by distributed solar roll-out is that the jobs require a variety of skills and pay a variety of salaries. Working in the solar industry can involve a broad range of tools and skills ranging from electrical work to sales to structural engineering. Similarly, the salaries range from just over $20,000 to nearly $80,000 per year. The table below displays the variety of jobs involved with distributed solar.

Source: The American Solar Energy Society. Green Collar Jobs in the U.S. and Colorado. December 2008.

Note: Data prepared for Colorado, salary range may differ for Nevada.

Distributed Solar – Part I

By Coalition for Green Capital

What is one of the biggest problems in the United States right now?

UNEMPLOYMENT.

Unemployment in the U.S. is currently 7.7%. While this number is an improvement from the high of 10% measured in October of 2009, it remains a disheartening reminder of America’s stagnant economic growth and widespread budget cuts.

How can the energy sector improve unemployment?

DISTRIBUTED SOLAR.

One of the best programs that has the ability to show widespread, accelerated expansion in the next year or two years is distributed solar. There have been numerous other energy-related ideas championed by the government and national energy experts in recent year; however, none have as great of an immediate impact on unemployment as distributed solar.

For example PACE (Property Assessed Clean Energy) is a fine idea; however, it requires more time to evolve. In order to provide commercial, industrial, and multi-family property owners affordable long-term financing resources for energy efficiency upgrades, PACE spreads the cost of the efficiency improvements over the expected life of the measure and can take years to reach completion. Similarly weatherization and other smart energy upgrades must be customized and are hamstrung by so many problems that they will take at least a year to get going at a rapid pace. Lastly, microgrids and similar efforts are laudable for reasons other than impact on unemployment.

Distributed solar appears to be the fastest and most effective way to improve unemployment through clean energy work. The basic math on jobs as a function of distributed solar, shows that distributed solar has enormous potential to create jobs across the country. Consider the following states:

Connecticut: The average capital spending per roof is $30,000 for 7 KW. The estimated addressable market is 80,000 homes – 10% of total residential market. Saturation of this market amounts to $2.4 billion in spending. That equals approximately 20,000 job years. Every year Connecticut accounts for about 1.5 million job years, so 20,000 accounts for 1.3% employment increase. If we assumed the spending were spread over four years, we would see an additional .35% increase in the population /employment ratio (roughly from 52% to 52.35%).

New York City: Several years ago, the City University of New York developed a map showing that 66.4% of the rooftops in New York City are suitable for Solar PV systems. Saturation of this market would amount to roughly $20 billion in spending. That equals approximately 166,667 job years.

In many American states, penetration is currently only a few percent of the total addressable market. Because an installer that persuades a customer to provide access to a roof would almost have to commit a felony to be dislodged, a competitive race to the rooftops is a practical way to stimulate consumer demand and therefore create much-needed jobs.

That would make the energy sector one of the largest contributors to growth in this critical ratio. It would mean that the contributions to job growth of this sector gave particular prominence to the clean energy

movement.

There do not appear to be any logistical obstacles to full saturation. There are more than enough distributed solar installers, operating under two different business models. Costs are dropping and as scale expands further cost declines seem certain.

The question of whether or not the country should push for full penetration of the distributed solar market is a yes or no question. In several states, such as Connecticut and New York, green banks could mobilize installers of both types of business models to press for changes in policy.

There would also have to be several changes made to policies that currently act as barriers to achieving market saturation:

- Rooftop solar must be allowed to substitute for grid power during outages;

- Rooftop solar must be able to monetize RECs;

- There must be a predictable plan for cash incentives;

- The approval and review processes must be streamlined and made more efficient;

- And the sale of surplus electrons off rooftops must be maximized and encouraged

There are counterarguments to the acceleration of distributed solar deployment; nonetheless, it is worth considering the potential impact on unemployment before settling for a laggard solar roll-out.

Additional articles:

Mireya Navarro, “Mapping Sun’s Potential to Power New York,” The New York Times, June 18, 2011. Available here.

Follow

The Clean Energy Future Blog

for links, analysis, and commentary on the world of green banks and clean energy investment